What is Heikin Ashi Smoothed and How Improve Your Trading?

The Heikin Ashi Smoothed Indicator (HAS) is an advanced tool that enhances traditional candlestick charting by filtering out market noise and providing clearer trend signals. This article will delve into the intricacies of the Heikin Ashi Smoothed Indicator, introduce Pineify—a powerful tool for creating and managing trading indicators—and guide you on how to effectively use these tools for trading success.

What is the Heikin Ashi Smoothed Buy Sell Indicator?

The Heikin Ashi technique, meaning "average bar" in Japanese, modifies the standard candlestick chart by averaging price data to reduce volatility and highlight trends. The traditional Heikin Ashi formula calculates the average of open, high, low, and close prices to create its candles. The smoothed version takes this a step further by applying additional smoothing techniques, such as moving averages, to the Heikin Ashi values.

Key Features of the Heikin Ashi Smoothed Indicator:

- Trend Clarity: The HAS provides a clearer view of market trends by reducing noise, making it easier for traders to identify bullish or bearish movements.

- Lagging Nature: While it offers enhanced trend visibility, the smoothing process introduces a lag in responsiveness to price changes, which traders must consider when making decisions.

- Signal Confirmation: The color changes in HAS candles can serve as confirmation signals for entries and exits when combined with other technical indicators.

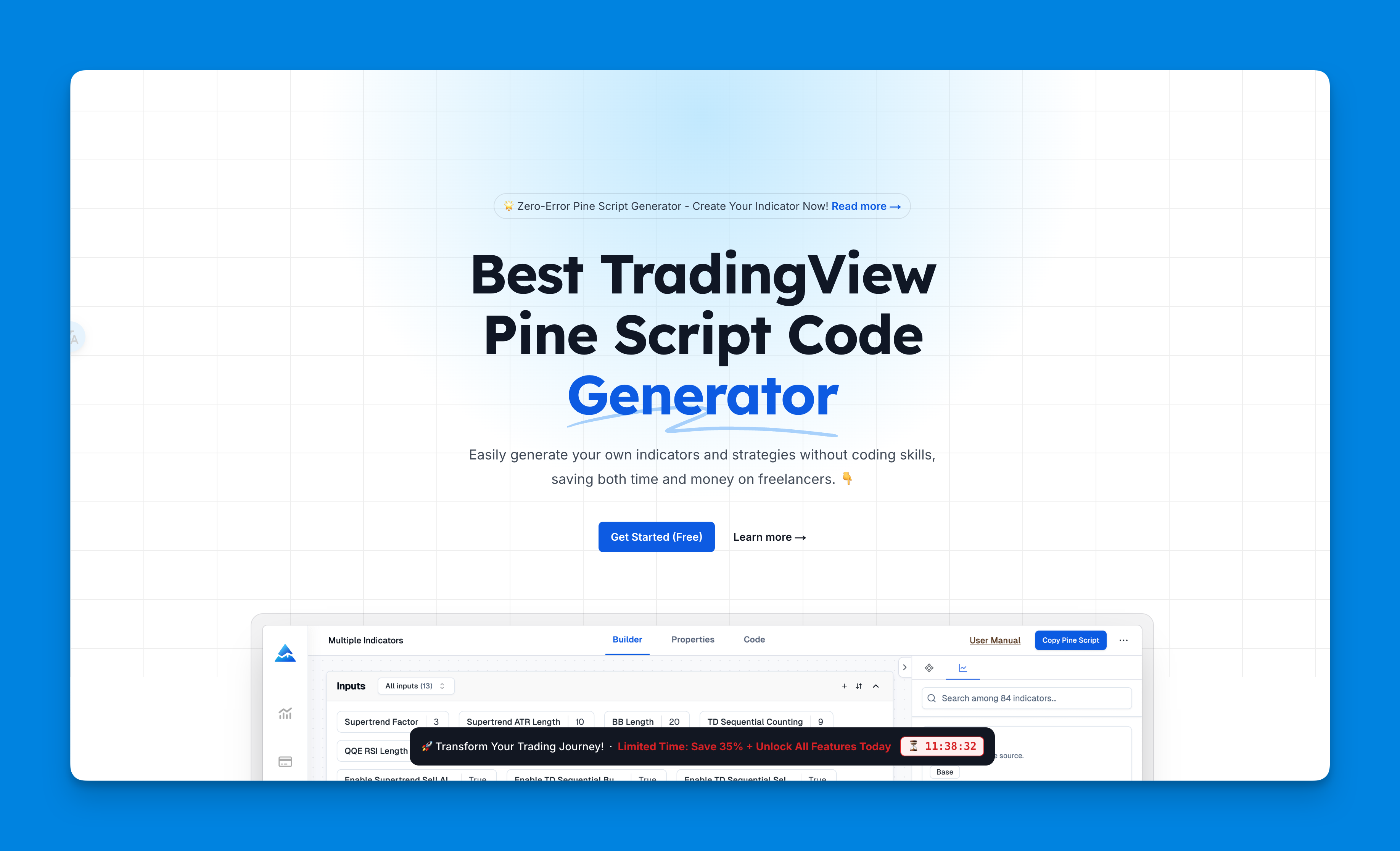

What is Pineify?

Pineify is an innovative platform designed for traders using TradingView. It allows users to create and manage custom trading indicators and strategies without requiring any coding skills. This user-friendly tool is particularly beneficial for those who want to leverage complex indicators like the Heikin Ashi Smoothed without getting bogged down by programming.

Features of Pineify:

- No Coding Required: Easily build indicators using visual tools, making it accessible for all traders.

- Unlimited Indicators: Unlike TradingView's standard limitations, Pineify allows users to add an unlimited number of indicators to their charts.

- Powerful Condition Editor: Combine multiple technical indicators and price data to create precise trading rules tailored to your strategy.

- Backtesting Capabilities: Test any created indicator or strategy against historical data to validate its effectiveness before live deployment.

How to Get Heikin Ashi Smoothed Code Using Pineify

Integrating the Heikin Ashi Smoothed Indicator into your trading setup using Pineify is straightforward. Here’s how you can do it:

- Visit Pineify's Homepage: Start by navigating to the Pineify website.

- Create a New Indicator:

- Click on the "Create" button.

- Select "Indicator" from the options presented.

- Choose a blank template or an existing one that suits your needs.

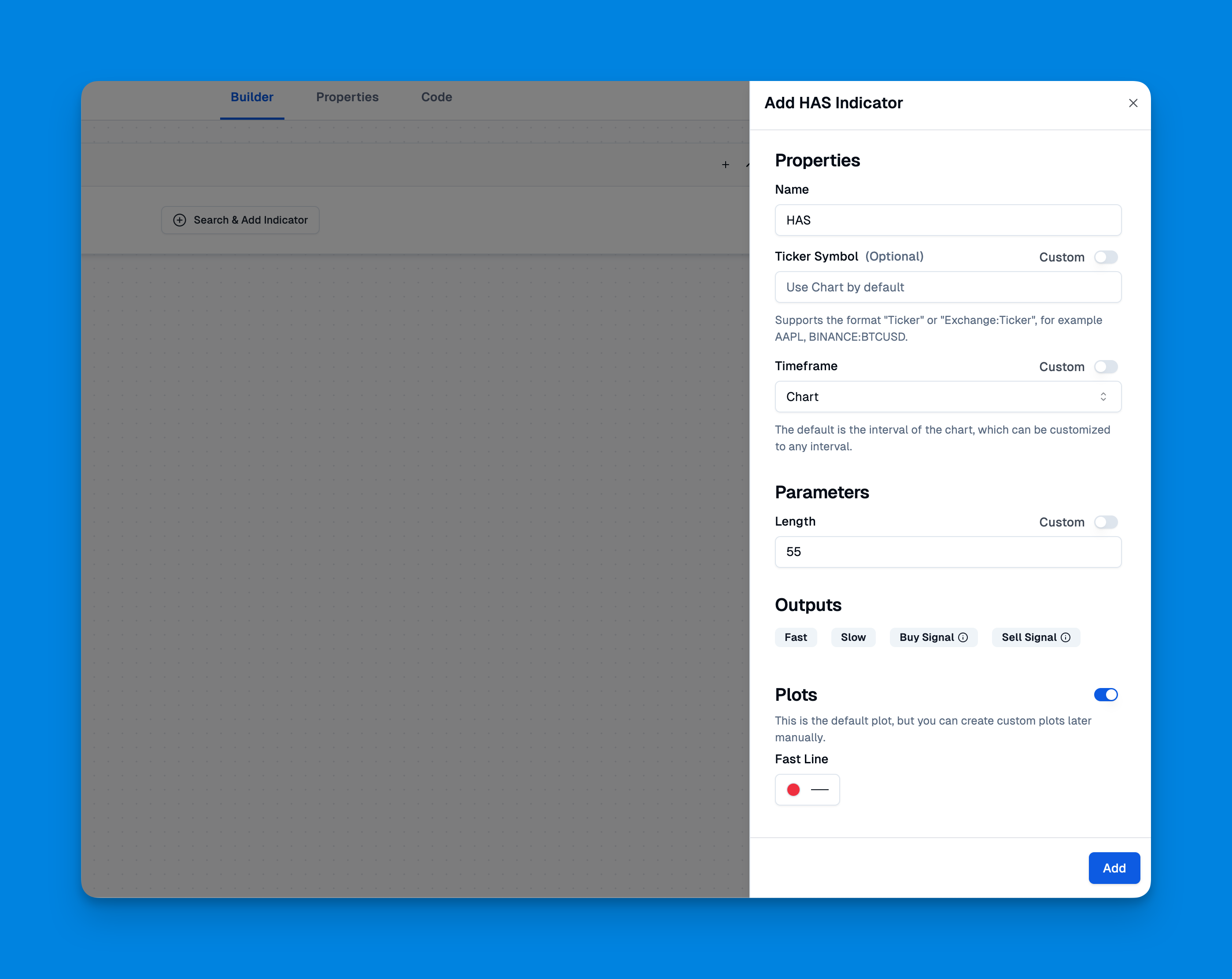

- Configure the Indicator:

- In the editor, search for "Heikin Ashi" and select it.

- Adjust the settings according to your preferences (e.g., length params).

- Add Moving Averages:

- To smoothen your Heikin Ashi values further, add moving averages (like SMA or EMA) as overlays.

- Set parameters such as length and type of moving average based on your trading strategy.

- Finalize and Copy Code:

- Once configured, click on "Copy Pine Code" to get your custom Pine Script.

- Paste this code into TradingView’s Pine Editor to add your new indicator to your charts.

Click here to view all the features of Pineify.

Best Heikin Ashi Smoothed Indicator Settings

The effectiveness of the Heikin Ashi Smoothed Indicator largely depends on its settings. Here are some recommended configurations:

- Smoothing Periods:

- Use shorter periods (e.g., 5) for more responsive signals during active markets.

- Opt for longer periods (e.g., 20) in quieter markets for reduced noise.

- Moving Average Type:

- Experiment with different types of moving averages (SMA vs. EMA) to find what best suits your trading style.

- Timeframe Considerations:

- The HAS works well across various timeframes; however, longer timeframes (daily or weekly) tend to yield more reliable signals due to reduced noise.

How to Trade with Heikin Ashi Smoothed Indicator

Trading with the Heikin Ashi Smoothed Indicator involves understanding its signals and integrating them into a broader strategy:

- Identifying Trends:

- Look for consecutive green (bullish) or red (bearish) HAS candles as indicators of prevailing trends.

- Entry Signals:

- Enter long positions when HAS candles turn green after a series of red candles.

- Conversely, enter short positions when HAS candles turn red following green candles.

- Exit Strategies:

- Consider exiting trades when there is a color change in HAS candles or when price action approaches significant support/resistance levels.

- Combining Indicators:

- Use HAS in conjunction with other indicators like RSI or MACD for additional confirmation before executing trades.

- Risk Management:

- Always employ stop-loss orders based on market volatility and your risk tolerance levels.

Conclusion

The Heikin Ashi Smoothed Indicator is an invaluable tool for traders looking to enhance their market analysis and decision-making processes. By utilizing Pineify, you can easily integrate this indicator into your trading strategy without needing extensive coding knowledge.

Embrace the power of these tools today! Start creating custom indicators with Pineify and elevate your trading experience by mastering the art of trend analysis with the Heikin Ashi Smoothed Indicator.

Ready to take your trading game to the next level? Explore Pineify now and unlock unlimited potential in your trading strategies!