Crafting a Winning Pine Script: strategy.entry

In the world of algorithmic trading, Pine Script is a powerful tool used on the TradingView platform to create and test trading strategies. One of the most crucial elements in any trading strategy is the strategy entry, which determines when to enter a trade. In this article, we’ll explore how to effectively use Pine Script to create a robust strategy entry, enhancing your trading performance and decision-making.

Understanding Pine Script Strategy Entry

Pine Script allows users to define trading strategies using the strategy() function, which enables the creation of hypothetical trades on historical and real-time data. The strategy.entry() function is key to entering trades, allowing you to specify conditions under which trades should be executed.

Key Parameters of strategy.entry()

- Trade ID: A unique identifier for each trade, useful for closing or modifying specific trades.

- Direction: Specify whether the trade is long (

strategy.long) or short (strategy.short). - Quantity: The number of shares or units to trade.

- Conditions: Additional criteria, such as technical indicators (e.g., RSI), that must be met before entering a trade.

Visualize Your Strategy: No-Code Trading Entry Mastery

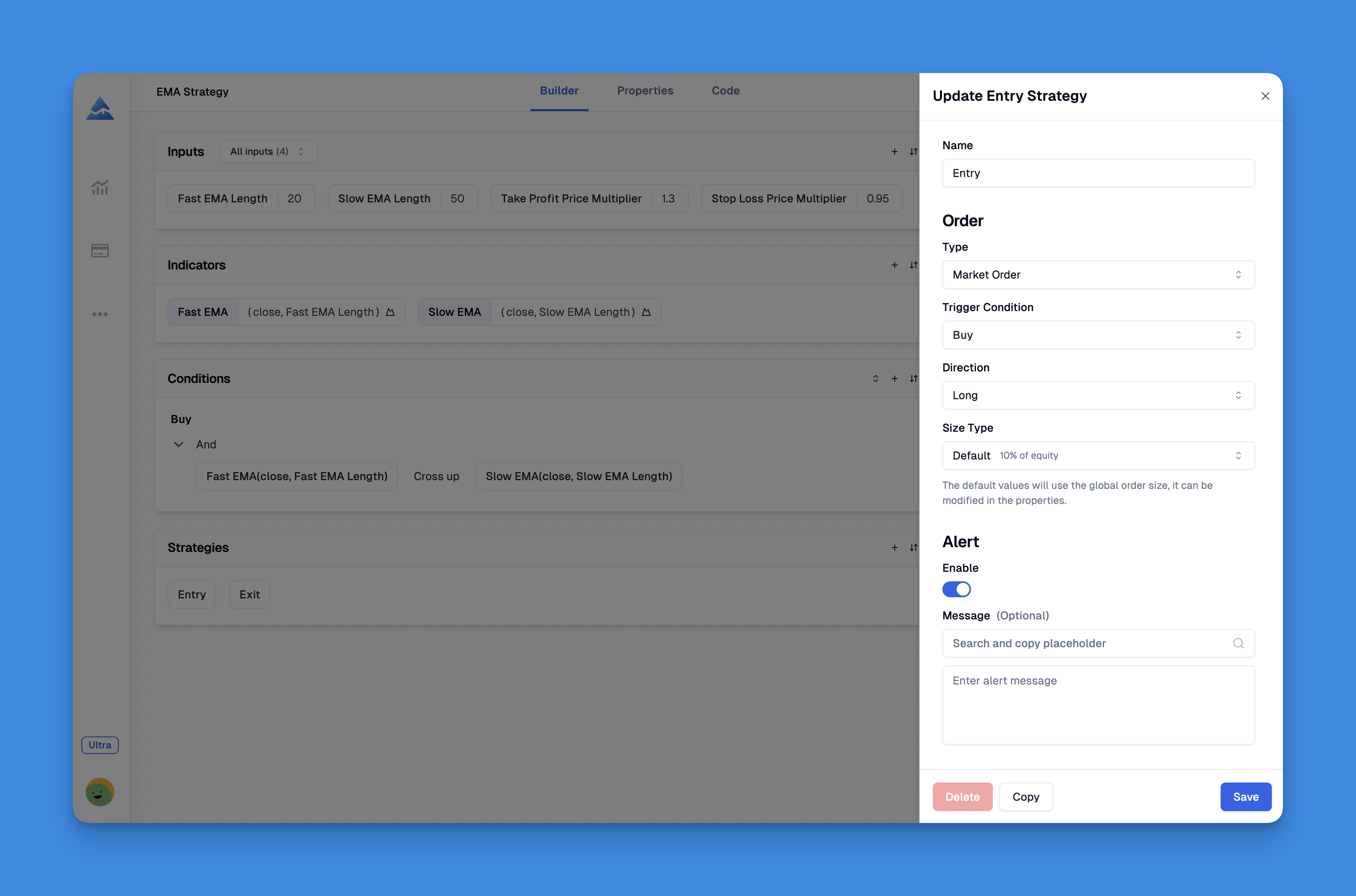

Pine Script strategy development can be a daunting task, but a shift toward no-code platforms is reshaping the trading landscape. With tools like Pineify, traders now have the ability to design and manage winning trading entries without the need to write a single line of code.

Leveraging a powerful visual interface, Pineify allows users to add unlimited technical indicators to their TradingView charts, breaking free from traditional two-indicator restrictions. This innovative approach empowers traders to experiment with various ticker symbols and timeframes while customizing inputs, alerts, and plots to suit their unique trading style.

Website: Pineify

Click here to view all the features of Pineify.Crafting a Compelling Strategy Entry

To create an effective strategy entry, consider the following steps:

- Define Your Trading Conditions:

- Use technical indicators like Moving Averages, RSI, or Bollinger Bands to trigger trades.

- Combine multiple conditions to refine your entry points.

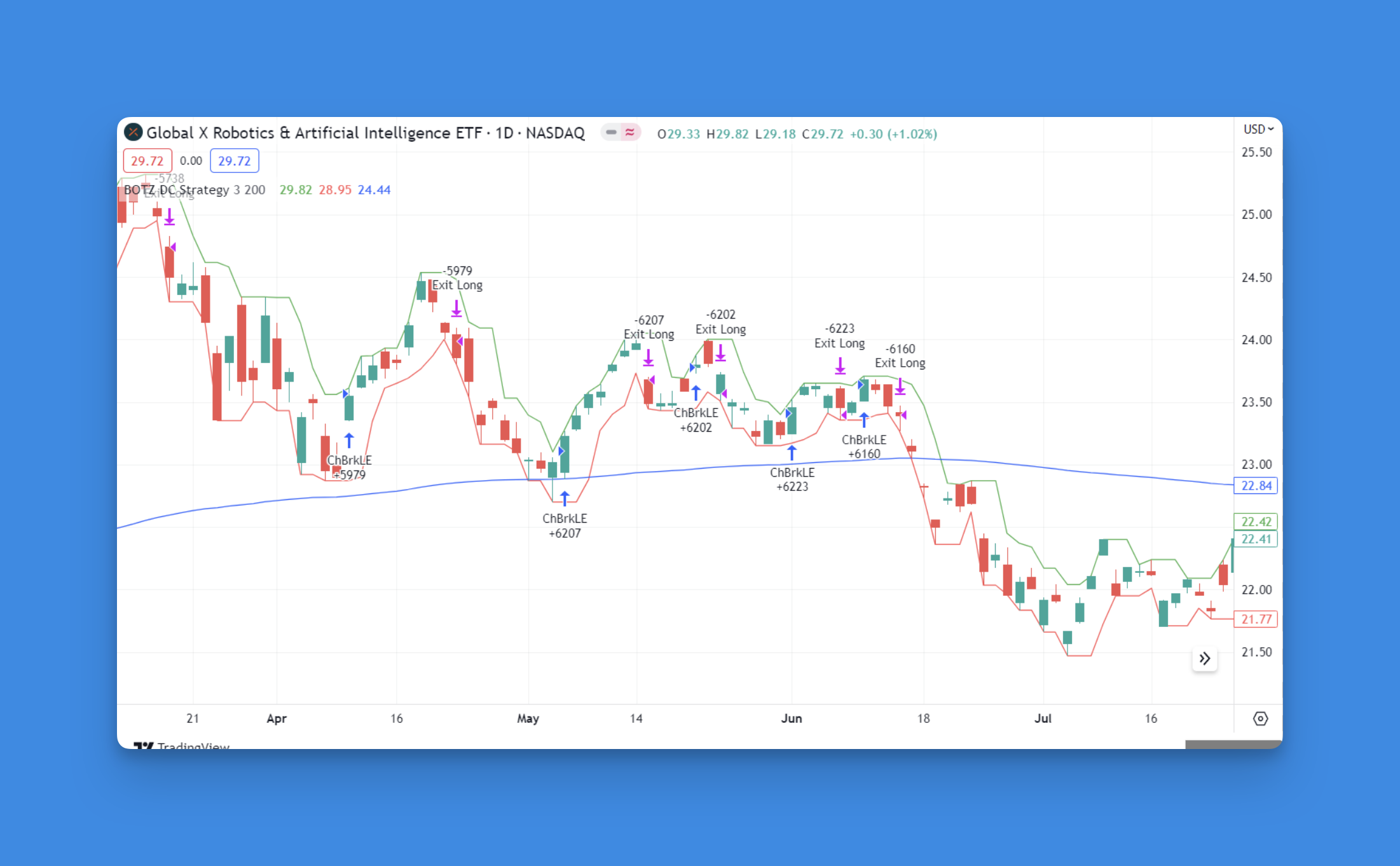

- Optimize with Backtesting:

- Use TradingView’s Strategy Tester to evaluate your strategy on historical data.

- Adjust parameters based on performance metrics like profit/loss ratio and drawdown.

- Consider Risk Management:

- Set stop-loss and take-profit levels to limit potential losses and lock in gains.

- Use position sizing strategies to manage risk per trade.

Example of a Simple Strategy Entry

Here’s a basic example using the RSI indicator:

//@version=5

strategy("RSI Strategy", overlay=true)

// Define RSI parameters

length = input(14, title="RSI Length")

src = close

rsi = ta.rsi(src, length)

// Define entry conditions

longCondition = ta.crossover(rsi, 30)

shortCondition = ta.crossunder(rsi, 70)

// Enter trades based on conditions

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.entry("Short", strategy.short)

Enhancing Your Strategy

- Use Multiple Indicators: Combine different indicators to create a robust entry system.

- Incorporate Market Sentiment: Use sentiment indicators to gauge market mood and adjust entries accordingly.

- Stay Adaptable: Continuously monitor and adjust your strategy based on changing market conditions.

Conclusion

Crafting a successful Pine Script strategy entry involves careful planning, testing, and optimization. By following these guidelines and continuously refining your approach, you can improve your trading outcomes and stay ahead in the market.