Mastering Pine Script: Leveraging the Power of strategy.exit

In the world of trading, managing positions effectively is crucial for maximizing profits and minimizing losses. Pine Script, a popular programming language used on TradingView, offers a robust tool for this purpose: the strategy.exit function. This article delves into the capabilities of strategy.exit, providing insights on how to use it to enhance your trading strategies.

Introduction to strategy.exit

The strategy.exit function is designed to create exit orders for open trades, allowing traders to manage their positions with precision. Unlike other order placement commands, strategy.exit can generate multiple types of exit orders in a single call, including take-profit, stop-loss, and trailing stop orders.

Key Features of strategy.exit

- Multi-Order Generation: A single call to

strategy.exitcan create multiple exit orders, such as limit orders for take-profit and stop orders for stop-loss. - Partial Exits: Traders can specify a portion of the position to close using

qtyorqty_percent, allowing for partial exits and multi-level strategies. - Trailing Stops: The function supports trailing stop orders, which adjust based on market movements, helping to lock in profits while limiting losses.

- One-Cancels-All (OCA) Groups: Orders can be grouped under an OCA name, allowing for automatic reduction of unfilled orders when one executes.

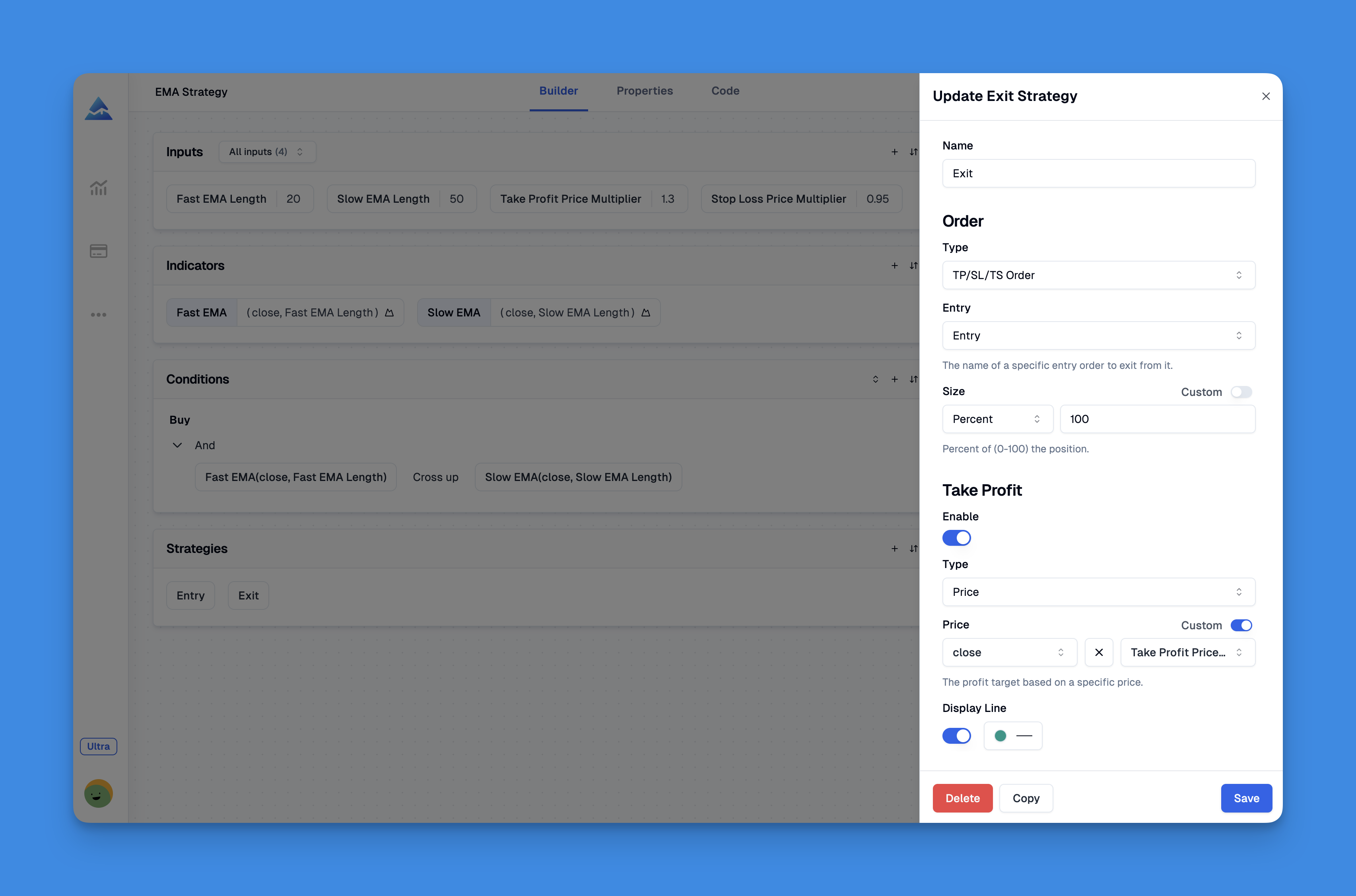

Streamlining Exit Strategies Without Coding: The Pineify Advantage

Trading success often hinges not just on entry timing but on well-executed exit strategies. While Pine Script's strategy.exit function offers powerful capabilities for implementing take-profit and stop-loss orders, mastering its syntax and parameters can be challenging for non-programmers. This is where tools like Pineify transform the trading experience for TradingView users.

Pineify's intuitive visual interface eliminates the coding barriers traditionally associated with developing sophisticated exit strategies. Through its comprehensive strategy tester, traders can easily configure market orders for entries while implementing flexible take-profit and stop-loss parameters to manage risk effectively. Rather than struggling with Pine Script's complex syntax, users can create precise exit conditions through the platform's powerful condition editor, which allows for the combination of multiple technical indicators, price data, and market variables.

Website: Pineify

Click here to view all the features of Pineify.How to Use strategy.exit

Basic Syntax

strategy.exit(id, from_entry, qty, qty_percent, profit, limit, loss, stop, trail_price, trail_points, trail_offset, oca_name, comment, comment_profit, comment_loss, comment_trailing, alert_message, alert_profit, alert_loss, alert_trailing, disable_alert) → void

Parameters Explained

id: Unique identifier for the exit order.from_entry: Specifies the entry order ID to exit from.qty/qty_percent: Quantity or percentage of the position to close.profit/limit: Parameters for take-profit orders.loss/stop: Parameters for stop-loss orders.trail_price,trail_points,trail_offset: Parameters for trailing stop orders.

Example Usage

Here’s an example of using strategy.exit to create a simple exit strategy with static stop-loss and take-profit levels:

//@version=5

strategy("MACD Strategy", overlay=true)

// Define MACD parameters

MACD = ta.ema(close, 12) - ta.ema(close, 26)

aMACD = ta.ema(MACD, 9)

delta = MACD - aMACD

// Entry conditions

if (ta.crossover(delta, 0))

strategy.entry("MacdLE", strategy.long, comment="MacdLE")

// Exit strategy

strategy.exit("SL_PT", "MacdLE",

loss = (0.03 * close) / syminfo.mintick,

profit = (0.05 * close) / syminfo.mintick)

Best Practices for Using strategy.exit

- Use Specific IDs: Ensure each exit order has a unique ID for easy management.

- Test Strategies: Always test your strategies in a simulated environment before applying them to live markets.

- Monitor Performance: Regularly review your strategy’s performance and adjust parameters as needed.

Conclusion

The strategy.exit function in Pine Script is a powerful tool for traders looking to refine their exit strategies. By understanding its capabilities and incorporating it into your trading scripts, you can enhance your position management and potentially improve your trading outcomes.