Pine Script ATR Stop Loss: Enhancing Trading Strategies

In the world of trading, managing risk effectively is crucial for maintaining profitability and minimizing losses. One powerful tool traders use is the Average True Range (ATR) indicator, which can be integrated into Pine Script to create dynamic stop-loss strategies. This article explores how to leverage Pine Script to implement ATR-based stop-losses, providing traders with a flexible approach to risk management.

What is ATR and How Does it Work?

Average True Range (ATR) measures market volatility by calculating the average range of price movements over a specified period. It helps traders understand how much an asset typically moves, allowing them to adjust their stop-loss levels accordingly. By using ATR, traders can ensure that their stop-losses are neither too tight, risking premature stop-outs, nor too loose, leaving them exposed to unnecessary losses.

Setting Up ATR Stop-Losses in Pine Script

Implementing ATR stop-losses in Pine Script involves a few straightforward steps:

- Choose Your ATR Period: Typically, a 14-period ATR is used, but this can be adjusted based on your trading strategy.

- Select an ATR Multiplier: This depends on your trading style:

- Day Trading: 1.5x to 2x

- Swing Trading: 2x to 3x

- Position Trading: 3x to 4x

- Calculate Stop-Loss Levels:

- For long trades:

Stop Loss = Entry Price - (ATR × Multiplier) - For short trades:

Stop Loss = Entry Price + (ATR × Multiplier)

- For long trades:

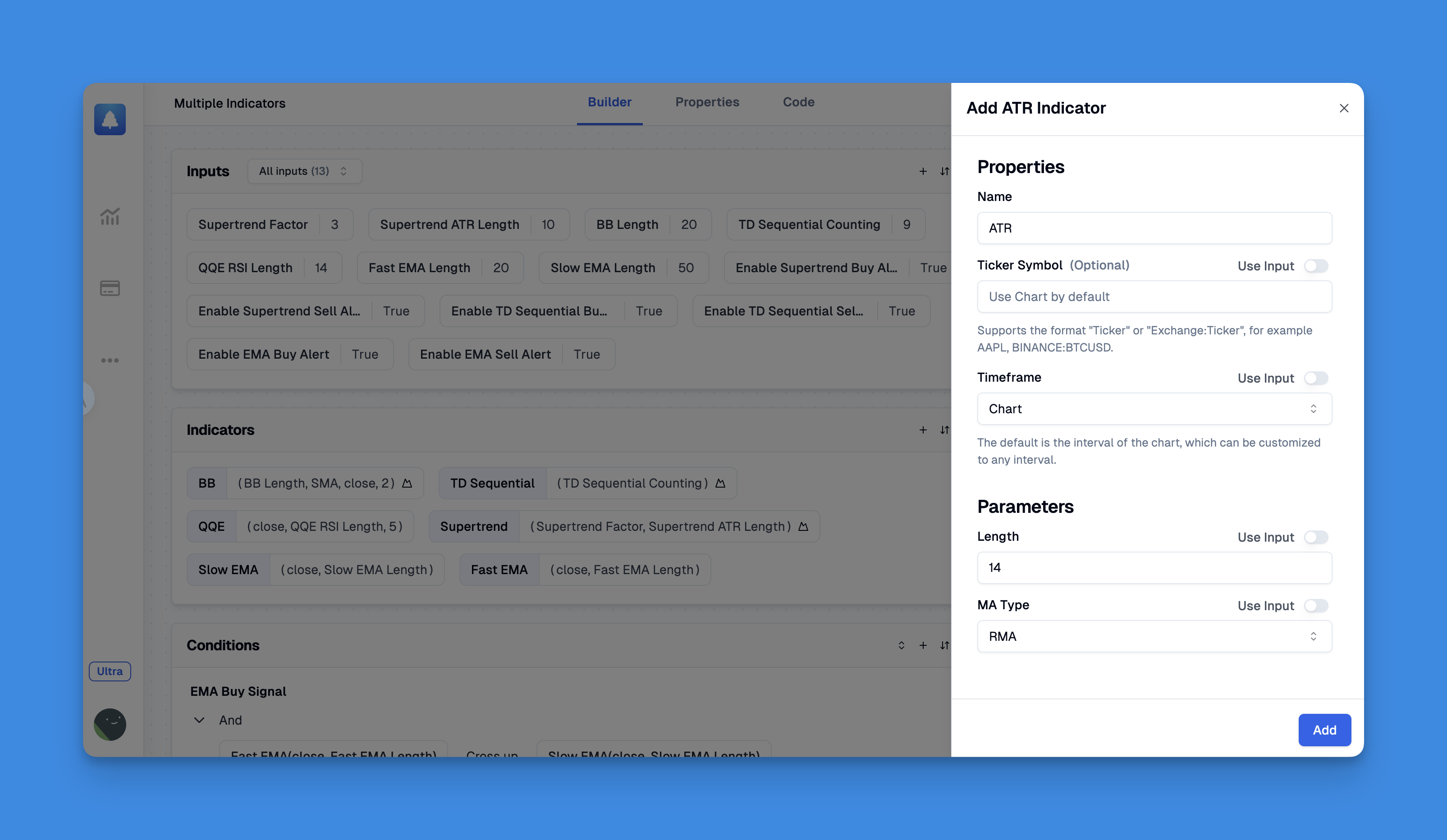

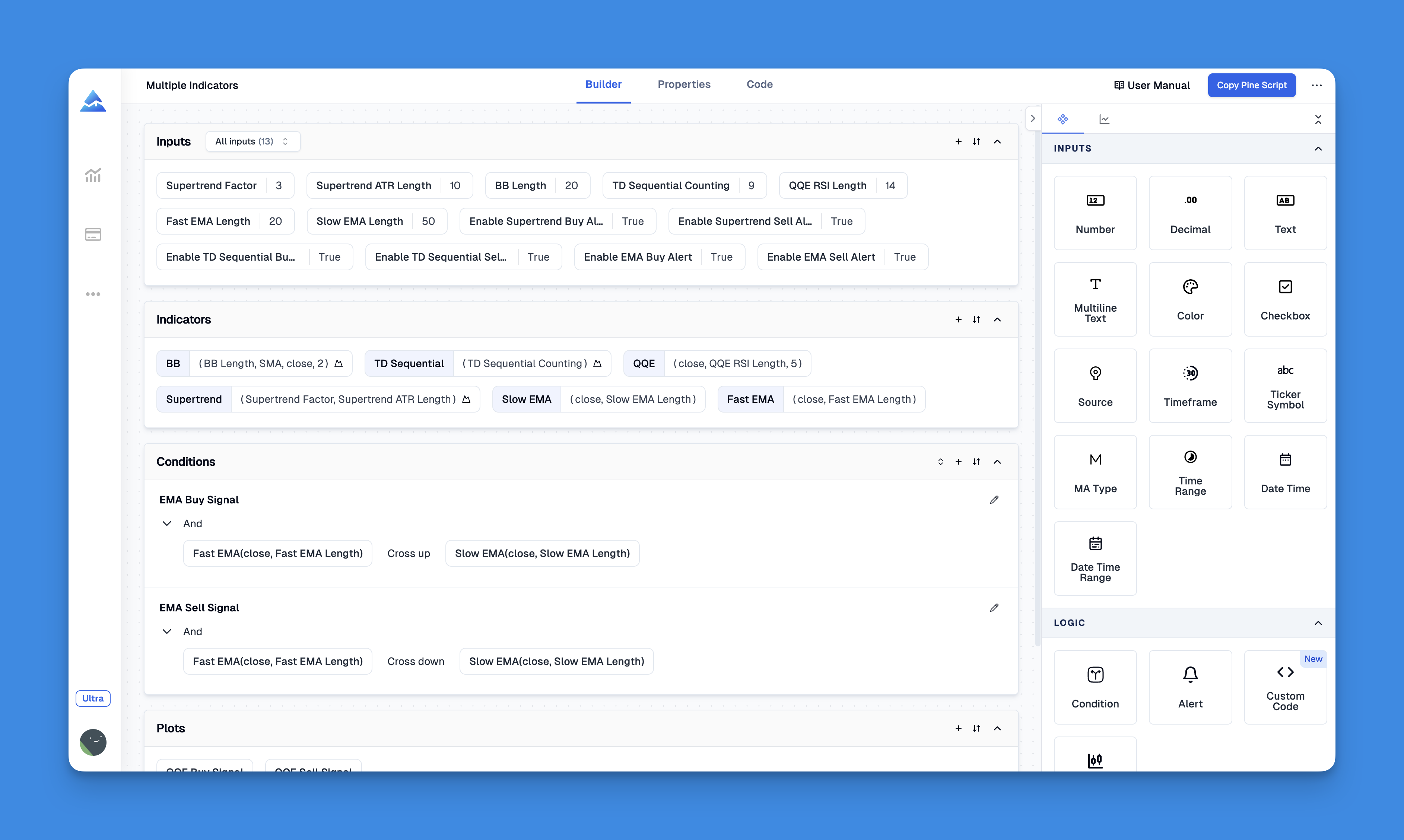

Enhancing ATR Stop Loss Strategies with Pineify's Visual Toolkit

Website: Pineify

Pineify empowers traders to implement sophisticated ATR-based stop loss mechanisms without writing a single line of Pine Script. The platform’s Condition Editor enables dynamic risk management by allowing users to combine Average True Range values with price action data, volatility thresholds, and multiple technical indicators through an intuitive drag-and-drop interface. Traders can set trailing stops that automatically adjust based on market volatility by linking stop-loss levels to ATR calculations, while simultaneously incorporating momentum filters or trend confirmation rules for higher precision.

The Import Custom Code feature simplifies the process of integrating existing ATR stop loss scripts into new strategies. Users can modify variables like ATR period length (e.g., 14-day default) or multiplier values (e.g., 2x ATR for wider stops) through visual input fields rather than code editing. Pineify’s Unlimited Indicators capability allows combining ATR stops with complementary tools like RSI divergence or volume-weighted moving averages, overcoming TradingView’s two-indicator limit for free accounts.

Example Pine Script for ATR Stop-Loss

Here’s a basic example of how to implement an ATR stop-loss line in Pine Script:

You can see the corresponding stop loss price when entering at the closing price.

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Pineify

//======================================================================//

// ____ _ _ __ //

// | _ \(_)_ __ ___(_)/ _|_ _ //

// | |_) | | '_ \ / _ \ | |_| | | | //

// | __/| | | | | __/ | _| |_| | //

// |_| |_|_| |_|\___|_|_| \__, | //

// |___/ //

//======================================================================//

//@version=6

strategy("[Pineify - Best Pine Script Generator] ATR Stop line", overlay=true)

atrPeriod = input(14, "ATR Period")

atrMultiplier = input(2, "ATR Multiplier")

atr = ta.atr(atrPeriod)

stopLevel = close - (atr * atrMultiplier)

plot(stopLevel, color=color.red, title="ATR Stop")

Benefits of Using ATR Stop-Losses

- Dynamic Risk Management: ATR stop-losses adjust to changing market conditions, ensuring that your risk exposure is always aligned with current volatility.

- Reduced Drawdown: By adapting to market movements, ATR stops can help minimize drawdowns compared to fixed stop-loss levels.

- Improved Trading Flexibility: Whether you’re day trading or position trading, ATR stops offer a versatile approach to managing risk.

Tips for Effective ATR Stop-Loss Implementation

- Monitor Volatility: Increase your ATR multiplier during high volatility to avoid premature stop-outs.

- Combine with Other Indicators: Use ATR stops alongside trend indicators like moving averages to enhance trade accuracy.

- Regularly Update ATR Values: Ensure your trading platform updates ATR values in real-time to reflect current market conditions.

Conclusion

Implementing ATR stop-losses in Pine Script offers traders a powerful tool for managing risk in dynamic markets. By understanding how to use ATR effectively, you can enhance your trading strategies and improve overall performance.