TradingView vs NinjaTrader: Which Platform Is Better in 2025?

Choosing the right trading platform can significantly impact your trading success. In this comprehensive comparison, we’ll examine TradingView and NinjaTrader to help you decide which platform better suits your trading style and needs in 2025.

Core Platform Differences

TradingView and NinjaTrader serve different types of traders with distinct approaches to market analysis and trading execution.

TradingView excels as a user-friendly, web-based platform focused on technical analysis and social trading. Its intuitive interface makes it accessible for beginners while offering enough sophistication for experienced traders. The platform supports a wide range of assets including global stocks, cryptocurrencies, forex, and commodities.

NinjaTrader, on the other hand, is designed for professional-level trading with advanced execution capabilities and automation tools. It primarily focuses on futures and forex markets, offering direct broker integration for precise trade execution.

Feature Comparison

| Feature | TradingView | NinjaTrader |

|---|---|---|

| Platform Type | Web-based with desktop/mobile apps | Desktop-focused with limited web access |

| Primary Markets | Global stocks, crypto, forex, commodities | Futures (main focus), forex, stocks |

| Charting Capabilities | Pine Script for custom indicators | NinjaScript (more advanced) |

| Real-time Data | Multiple sources (some delays possible) | Direct broker feeds with low latency |

| Trading Execution | Broker-dependent, basic order types | Direct order execution, advanced options |

| Automation | Alert-based, limited automation | Advanced trading bots, custom strategies |

| Community Features | Strong social trading network | Minimal community integration |

| Learning Curve | Easier, more intuitive | Steeper learning curve |

| Cost Structure | Free basic plan with tiered premium options | Free charting with paid license for trading |

| Device Support | Cross-platform (web, mobile, desktop) | Primarily desktop with basic mobile features |

TradingView's Extensibility: Third-Party Tools Enhance Trading Experience

When comparing TradingView and NinjaTrader in 2025, a significant advantage for TradingView is its growing ecosystem of third-party tools that dramatically enhance its functionality.

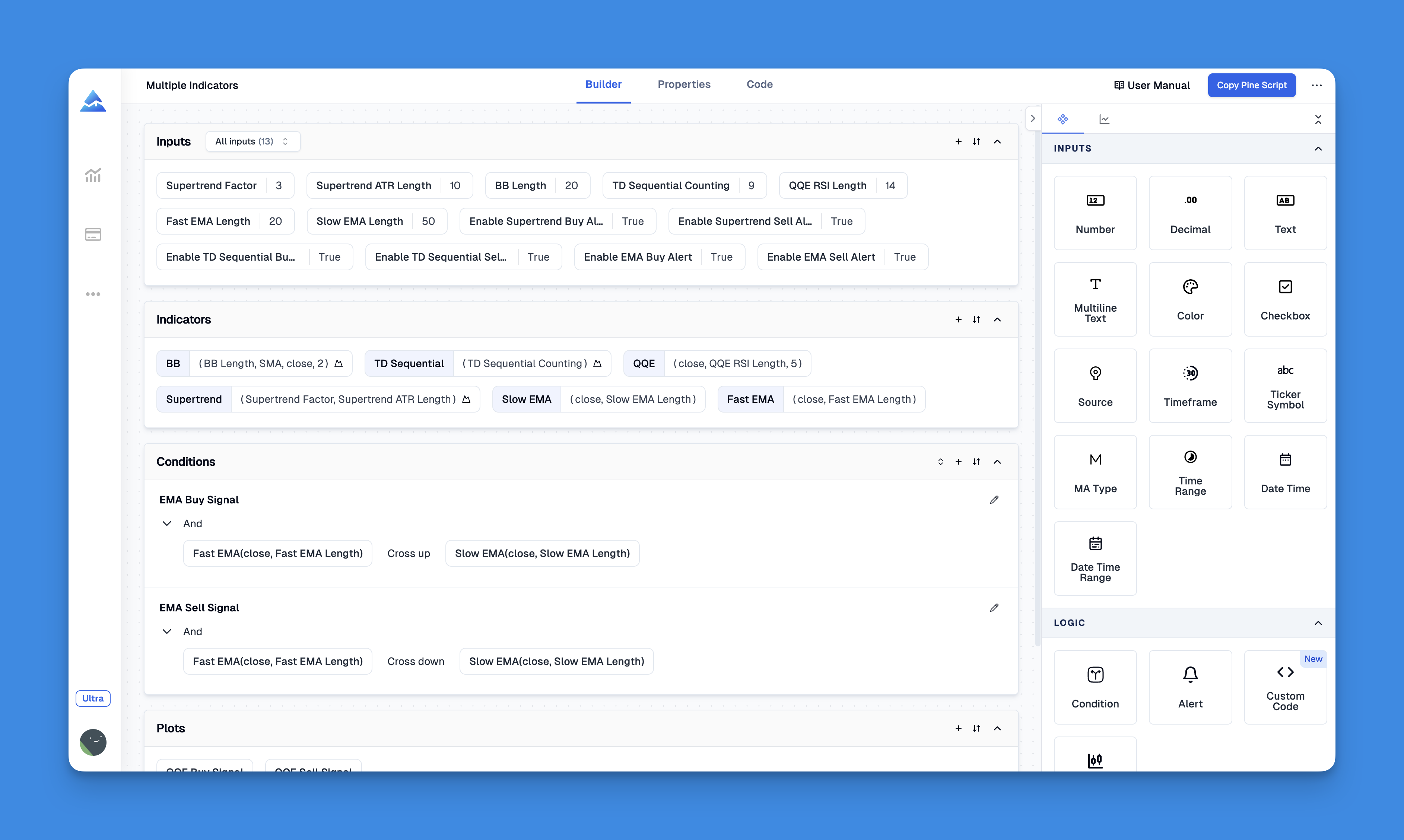

One standout example is Pineify, which transforms TradingView into a more powerful and accessible platform for traders of all skill levels. This tool allows users to create custom indicators and strategies without any coding knowledge, effectively democratizing advanced technical analysis that would otherwise require Pine Script programming expertise.

Website: Pineify

Click here to view all the features of Pineify.Technical Analysis Tools

TradingView’s Analysis Capabilities

TradingView provides extensive charting tools with built-in indicators and drawing features. Its Pine Script language allows users to create custom indicators for detailed analysis. The platform’s user-friendly interface makes complex technical analysis more accessible, even for beginners.

Key strengths include:

- Intuitive chart creation and manipulation

- Extensive built-in indicators

- Social sharing of chart ideas

- Cross-device synchronization

NinjaTrader’s Technical Edge

NinjaTrader focuses on delivering professional-grade charting with specialized features like tick charts, range bars, and Renko charts. Its NinjaScript language enables the creation of more advanced custom indicators and automated strategies compared to TradingView’s Pine Script.

NinjaTrader excels with:

- Advanced chart types (tick, range, Renko)

- Professional-level indicators

- More powerful scripting capabilities

- Superior backtesting functionality

Trading and Automation

NinjaTrader stands out for automated trading, particularly in futures and forex markets. It integrates directly with brokers and supports advanced automation, including multi-timeframe analysis and specialized order types. This makes it ideal for day traders and scalpers who need quick execution.

TradingView focuses more on analysis and alerts rather than direct execution. While it offers automation through Pine Script and alert-based execution, it’s better suited for strategic planning than high-frequency trading.

User Experience and Accessibility

TradingView offers a more accessible experience with its web-based platform and intuitive interface. You can simply visit the website, open a market, and start charting without downloading additional software10. It also provides a free plan with enough features to get started, though ads may affect the experience.

NinjaTrader requires downloading a desktop application, creating a steeper initial barrier to entry11. However, once set up, it provides a powerful environment for serious traders who need advanced capabilities.

Cost Considerations

TradingView operates on a subscription model with tiered pricing:

- Free basic plan with limited features

- Premium plans with additional capabilities

- All data feeds included in subscription

NinjaTrader offers:

- Free charting capabilities

- One-time license fee for trading features

- Additional costs for specialized data feeds

While NinjaTrader may be more cost-effective long-term with its one-time license fee, TradingView’s subscription model provides more flexibility for casual traders12.

Which Platform Is Right For You?

Choose TradingView if you:

- Want tools for analyzing multiple asset types, including cryptocurrencies

- Appreciate social trading features and community insights

- Need a web-based platform accessible across devices

- Prefer starting with a free plan and upgrading over time13

Choose NinjaTrader if you:

- Focus on futures or forex trading

- Require high-level automation and direct market access

- Need professional-grade tools for precise execution

- Are ready to invest in a platform with advanced trading capabilities14

Conclusion

By 2025, both platforms have continued to evolve while maintaining their core strengths. TradingView remains the go-to platform for user-friendly analysis and social trading across multiple asset classes, while NinjaTrader continues to serve professional traders with advanced execution and automation tools.

For most beginners and those who value ease of use and cross-device access, TradingView offers the better starting point. However, serious futures traders and those requiring advanced automation will find NinjaTrader’s capabilities worth the steeper learning curve.

Ultimately, your choice should align with your trading style, preferred markets, and specific needs. Many professional traders even use both platforms – TradingView for initial analysis and idea generation, and NinjaTrader for execution and automation.