Mastering Pine Script Trailing Stop Loss: A Complete Guide

Trading in financial markets requires effective risk management, and trailing stop losses are a powerful tool for protecting profits while allowing trades room to grow. For TradingView users, Pine Script offers a flexible way to implement custom trailing stops. In this comprehensive guide, we’ll explore how to create and optimize trailing stop losses in Pine Script to enhance your trading strategies.

What is a Trailing Stop Loss?

A trailing stop loss is a dynamic exit mechanism that automatically adjusts as the price moves in your favor. Unlike a fixed stop loss that remains at a set price, a trailing stop “trails” behind the price at a specified distance, helping to lock in profits while still giving the trade room to develop.

The key advantage of trailing stops is their ability to protect accumulated profits while allowing for continued upside potential. When implemented correctly in Pine Script, they can significantly improve your risk management and overall trading performance.

Types of Trailing Stops in Pine Script

Pine Script offers several methods to implement trailing stops, each with unique characteristics:

ATR-Based Trailing Stops

The Average True Range (ATR) indicator measures market volatility, making it ideal for creating adaptive trailing stops that adjust to changing market conditions.

An ATR-based trailing stop will:

- Widen during volatile periods to avoid premature exits

- Tighten during calmer market conditions

- Automatically adapt to the specific instrument’s price action

Percentage-Based Trailing Stops

This method sets the trailing stop at a fixed percentage distance from the current price or a recent swing point.

For example, a 2% trailing stop on a long position would exit the trade if the price falls 2% from its highest point since entry.

Swing High/Low Trailing Stops

This approach uses recent swing points (highs for short trades, lows for long trades) as reference points for the trailing stop, often combined with an offset value.

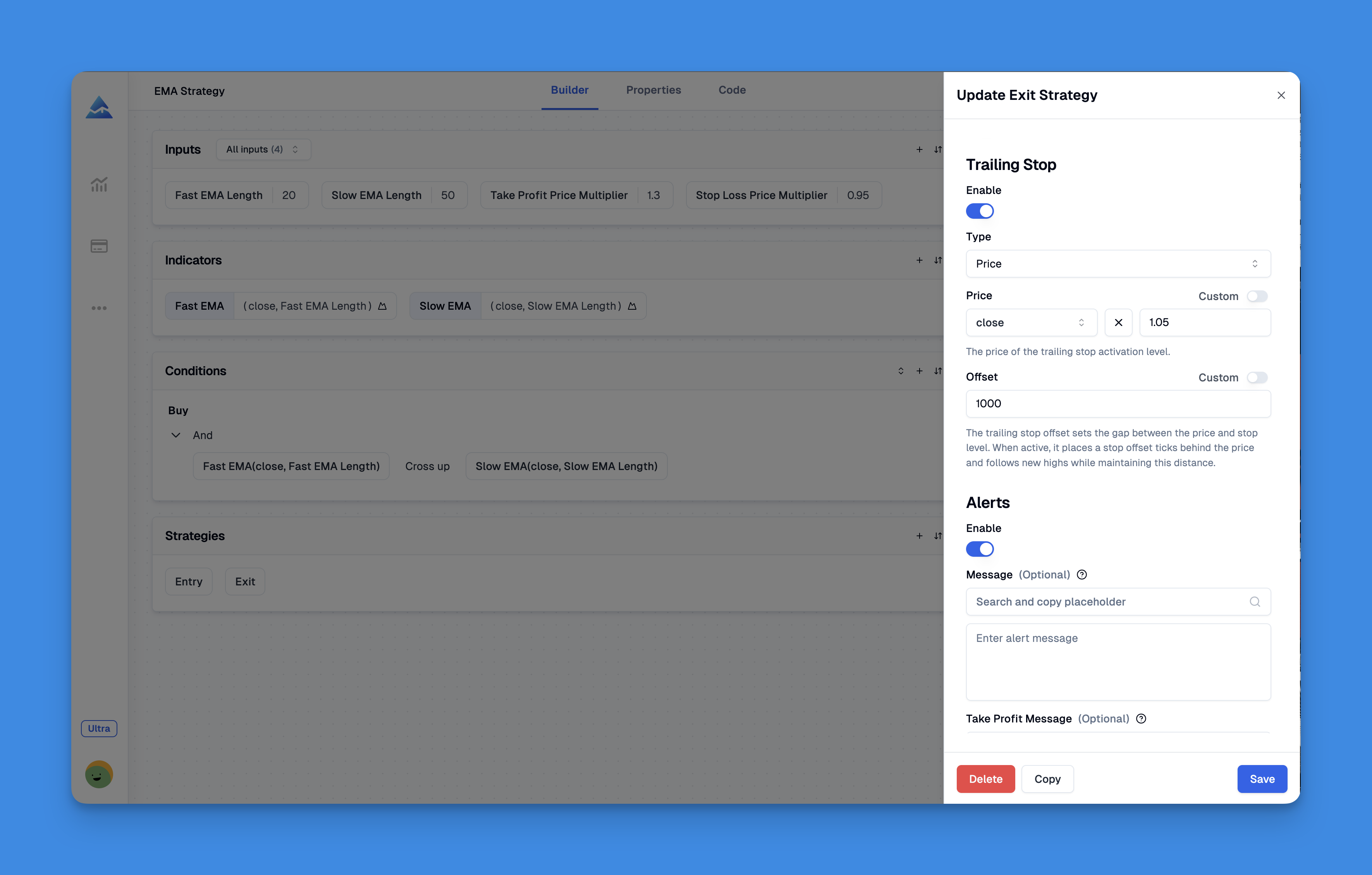

Integrating Pineify for Effortless Trailing Stop Loss Implementation

Pineify offers traders a revolutionary way to implement advanced trailing stop loss mechanisms in Pine Script without writing code. This no-code platform enables precise risk management through its visual strategy builder, allowing traders to define dynamic exit rules that adapt to market conditions.

By democratizing access to sophisticated risk management tools, Pineify empowers traders to build institutional-grade trailing stop systems through an intuitive visual interface. The platform's error-checked code generation ensures reliable execution, while its multi-timeframe support enables consistent strategy application across different trading horizons.

Website: Pineify

Click here to view all the features of Pineify.Implementing a Basic Trailing Stop in Pine Script

Let’s examine the core components needed to create a trailing stop in Pine Script:

// Declare trailing price variable (stores our trail stop value)

var float trailPrice = na

float next_trailPrice = na

// Calculate ATR value for potential use

atrValue = ta.atr(14) * 1.5 // 14-period ATR multiplied by 1.5

// For a long position with ATR-based trailing stop

if strategy.position_size > 0

// Calculate potential new trailing stop price

next_trailPrice := low - atrValue

// Only update trail price if it's higher than previous value or not yet set

if na(trailPrice) or next_trailPrice > trailPrice

trailPrice := next_trailPrice

// Exit trade if price closes below trailing stop

if strategy.position_size > 0 and close < trailPrice

strategy.close("Long Trade")

This basic implementation demonstrates the fundamental concept: calculate a potential new stop level, update it only if it’s more favorable than the current one, and exit when the price violates the stop level.

Advanced Trailing Stop Techniques

Combining Multiple Timeframes

You can enhance your trailing stop by incorporating data from higher timeframes:

// Get higher timeframe data

higherTF_low = request.security(syminfo.ticker, "240", low)

higherTF_atr = request.security(syminfo.ticker, "240", ta.atr(14))

// Use higher timeframe data for trailing stop calculation

htf_stop = higherTF_low - higherTF_atr * 2

Conditional Trailing Stops

Different market conditions might call for different trailing stop approaches:

// Adjust trailing stop based on volatility conditions

if ta.atr(14) > ta.atr(14)[20] * 1.5 // If current volatility is 50% higher than 20 bars ago

// Use wider trailing stop in volatile conditions

trail_distance := atrValue * 2

else

// Use tighter trailing stop in normal conditions

trail_distance := atrValue

Optimizing Your Trailing Stop Parameters

The effectiveness of your trailing stop depends on proper parameter selection:

ATR Period

- Shorter periods (7-14): More responsive but potentially more whipsaw

- Longer periods (20-50): Smoother but may be slower to adapt

ATR Multiplier

- Lower values (0.5-1.5): Tighter stops, better profit protection but more likely to be triggered

- Higher values (2-3.5): More room for price fluctuation but less profit protection

Lookback Period for Swing Points

When using swing highs/lows:

- Shorter lookbacks (5-10 bars): More responsive trailing

- Longer lookbacks (15-30 bars): More stable but slower to adapt

Complete Pine Script Trailing Stop Example

Here’s a more comprehensive example that includes both ATR and percentage-based trailing stops:

// This source code is subject to the terms of the Mozilla Public License 2.0

// © YourTraderName

//@version=5

strategy("Trailing Stop Strategy", overlay=true)

// User inputs

trailMethod = input.string(title="Trail Method", defval="ATR", options=["ATR", "Percent"])

atrPeriod = input.int(title="ATR Period", defval=14)

atrMultiplier = input.float(title="ATR Multiplier", defval=1.5)

trailPercent = input.float(title="Trail Percent", defval=2.0, minval=0.1)

swingLookback = input.int(title="Swing Lookback", defval=10)

// Strategy entry conditions (simplified example)

longCondition = ta.crossover(ta.sma(close, 14), ta.sma(close, 28))

shortCondition = ta.crossunder(ta.sma(close, 14), ta.sma(close, 28))

// Entry logic

if longCondition

strategy.entry("Long", strategy.long)

else if shortCondition

strategy.entry("Short", strategy.short)

// Trailing stop variables

var float trailPrice = na

float next_trailPrice = na

// Calculate reference values

atrValue = ta.atr(atrPeriod) * atrMultiplier

float swingLow = ta.lowest(low, swingLookback)

float swingHigh = ta.highest(high, swingLookback)

// Calculate trailing stop based on selected method

if trailMethod == "ATR"

if strategy.position_size > 0 // Long position

next_trailPrice := swingLow - atrValue

else if strategy.position_size < 0 // Short position

next_trailPrice := swingHigh + atrValue

else // Percentage method

if strategy.position_size > 0 // Long position

next_trailPrice := swingLow * (1 - trailPercent/100)

else if strategy.position_size < 0 // Short position

next_trailPrice := swingHigh * (1 + trailPercent/100)

// Update trailing stop price if needed

if strategy.position_size != 0

if strategy.position_size > 0 and (na(trailPrice) or next_trailPrice > trailPrice)

trailPrice := next_trailPrice

else if strategy.position_size < 0 and (na(trailPrice) or next_trailPrice < trailPrice)

trailPrice := next_trailPrice

// Plot trailing stop

plot(strategy.position_size != 0 ? trailPrice : na, color=color.red, title="Trailing Stop")

// Exit logic using trailing stop

strategy.exit("Trail Exit", stop=trailPrice)

Common Challenges and Solutions

Challenge: Stop Gets Triggered Too Easily

Solution: Increase your ATR multiplier or percentage value, or use a longer lookback period for swing points.

Challenge: Stop Doesn’t Protect Profits Effectively

Solution: Decrease your ATR multiplier or percentage value, or consider using the closing price rather than swing points as your reference.

Challenge: Code Doesn’t Update Stop Correctly

Solution: Ensure you’re using the var keyword to make your trailing stop variable persistent across bars, and verify your conditional logic for updating the stop.

Best Practices for Pine Script Trailing Stops

- Test thoroughly - Backtest your trailing stop implementation across different market conditions

- Consider volatility - ATR-based stops generally outperform fixed percentage stops in volatile markets

- Use appropriate timeframes - Match your trailing stop parameters to your trading timeframe

- Visualize your stops - Always plot your trailing stop on the chart for visual verification

- Implement proper alerts - Create alerts when your trailing stop is updated or triggered

Conclusion

A well-implemented trailing stop loss in Pine Script can significantly enhance your trading strategy by protecting profits while allowing winning trades to run. By understanding the different types of trailing stops and how to implement them effectively, you can create sophisticated risk management systems tailored to your specific trading approach.