Mastering Pine Script Strategy Entry Price for Enhanced Trading Performance

In the world of algorithmic trading, Pine Script is a powerful tool used by traders on TradingView to create and backtest trading strategies. One crucial aspect of these strategies is accurately capturing the entry price for trades. This article will guide you through understanding and optimizing the entry price in Pine Script, ensuring your trading strategies perform as intended.

Understanding Entry Price in Pine Script

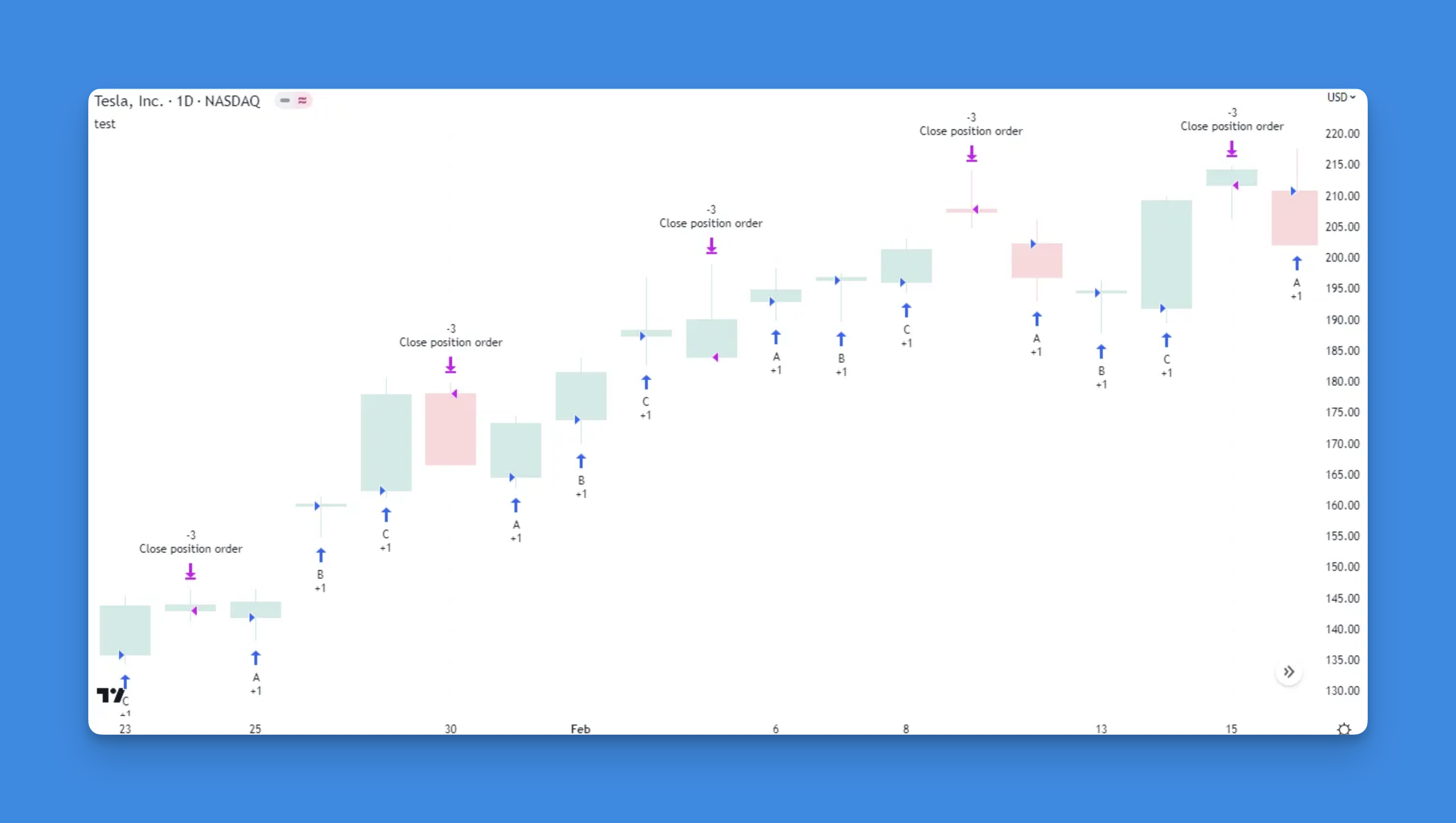

When using Pine Script, setting the entry price correctly is vital for calculating stop-loss and take-profit levels. However, discrepancies can occur between the actual entry price seen in the Strategy Tester and what is recorded by the script. This discrepancy often arises due to how orders are processed—either at the close of the current bar or at the open of the next bar.

Key Considerations:

- Process Orders on Close: Setting

process_orders_on_close=trueallows orders to be executed at the close of the bar, which can provide a more accurate entry price for backtesting purposes. - Order Timing: Orders are typically filled at the next bar’s open unless specified otherwise, which can lead to slight price variations.

Capturing the Exact Entry Price

To capture the exact entry price, you can use the following methods:

- Use

strategy.position_avg_price: This built-in variable returns the average entry price for a position. However, it becomes available only after the entry bar closes. - Set

calc_on_order_fills=true: This setting recalculates the strategy immediately after an order is filled, allowing access to the entry price on the same bar. - Use

strategy.opentrades.entry_price(strategy.opentrades - 1): This method retrieves the entry price of the most recent trade.

Example Code Snippet

Here’s a simple example of how to capture and use the entry price in a Pine Script strategy:

//@version=5

strategy("Entry Price Example", overlay=true)

// Parameters

length = input(14, title="ATR Length")

multiplier = input.float(2.0, title="ATR Multiplier")

// Calculate ATR

atr = ta.atr(close, length) * multiplier

// Entry Condition

longCondition = ta.crossover(close, ta.sma(close, length))

if (longCondition)

strategy.entry("Long Entry", strategy.long)

// Capture Entry Price

entryPrice = strategy.position_avg_price

// Set Stop-Loss and Take-Profit

stopLoss = entryPrice - atr

takeProfit = entryPrice + atr

// Exit Conditions

if (strategy.position_size > 0)

strategy.exit("Exit Long", "Long Entry", stop=stopLoss, limit=takeProfit)

Tips for Optimizing Your Strategy

- Backtest Thoroughly: Always backtest your strategy across different market conditions to ensure robustness.

- Monitor Performance: Use metrics like profit/loss ratio and drawdown to evaluate strategy performance.

- Adjust Parameters: Fine-tune parameters such as ATR length and multiplier based on backtest results.

Conclusion

Accurately capturing the entry price in Pine Script is crucial for effective trading strategy development. By understanding how orders are processed and using the right methods to capture entry prices, you can enhance your strategy’s performance. Whether you’re a seasoned trader or just starting out, mastering these techniques will help you refine your trading approach and achieve better results.