Mastering Pine Script Take Profit: A Guide to Optimizing Trading Strategies

In the world of trading, mastering the art of setting take profit levels is crucial for maximizing returns while minimizing risks. Pine Script, a powerful tool offered by TradingView, allows traders to automate their trading strategies, including setting take profit orders. This article will delve into the basics of Pine Script take profit, how to implement it effectively, and provide tips for optimizing your trading strategies.

What is Pine Script Take Profit?

Take profit in Pine Script refers to the price level at which a trade is automatically closed to lock in profits. It is a key component of risk management, helping traders avoid potential losses by securing gains when the market moves in their favor.

Implementing Take Profit in Pine Script

To set a take profit in Pine Script, you need to define the conditions under which you want to exit a trade. Here’s a basic example of how to do this:

// Define the take profit percentage

takeProfitPercentage = input(10, title='Take Profit %', step=0.1) / 100

// Calculate the take profit level based on the entry price

takeProfitLevel = strategy.position_avg_price * (1 + takeProfitPercentage)

// Use strategy.exit to set the take profit

strategy.exit("Take Profit", "Long", limit=takeProfitLevel)

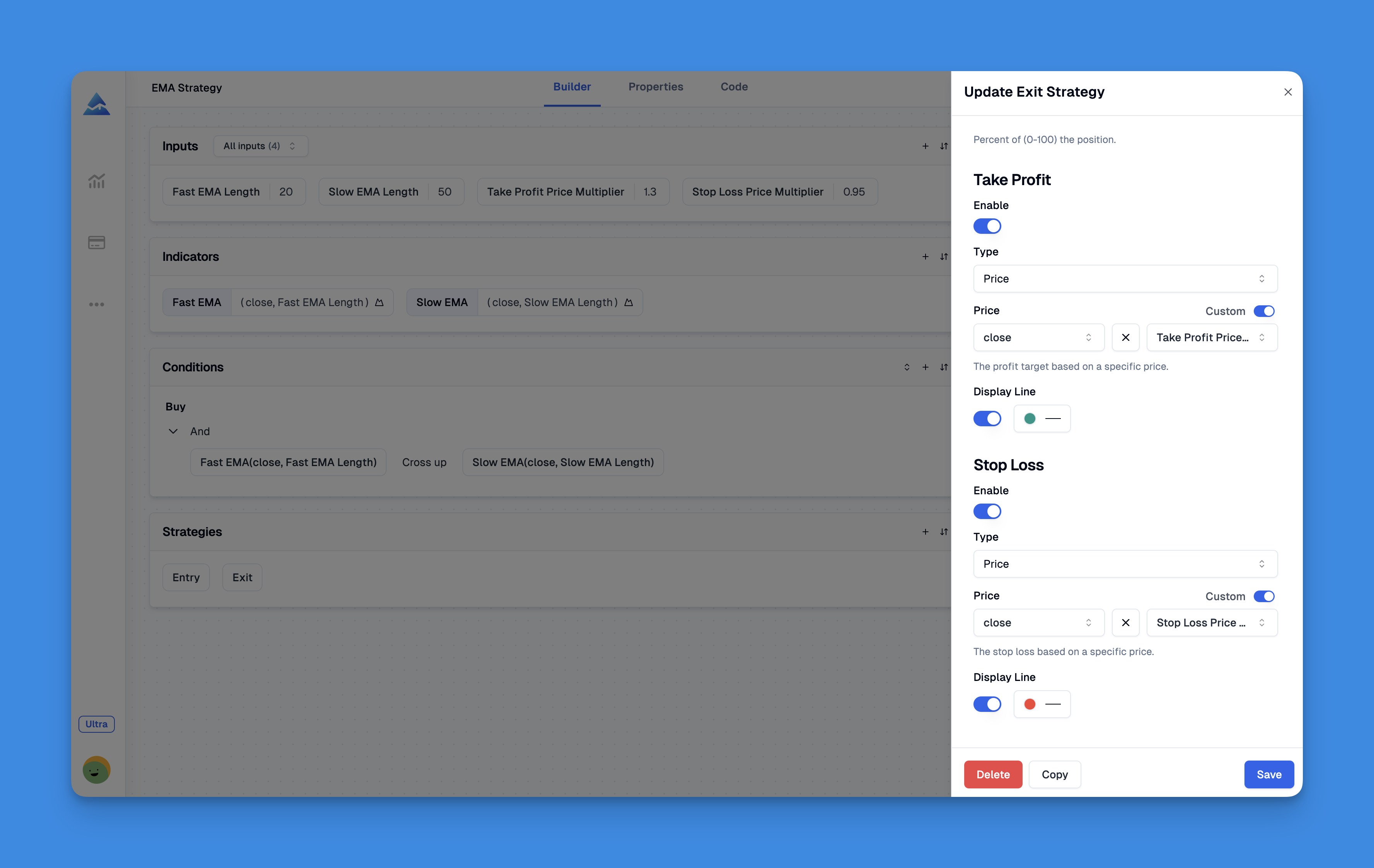

Streamlining Take Profit Implementation with Visual Tools

In the complex world of trading strategy development, implementing effective take profit mechanisms can be challenging, especially for traders without programming expertise. This is where visual Pine Script builders like Pineify offer a revolutionary approach to strategy optimization. With Pineify, traders can easily set up comprehensive take profit parameters without writing a single line of code.

The platform's intuitive condition editor allows you to construct precise and reliable trading rules by combining multiple technical indicators, price data, and market conditions. This visual approach enables traders to create sophisticated take profit strategies that might otherwise require extensive coding knowledge. For example, you can design a take profit strategy that adjusts dynamically based on market volatility or implements trailing stop mechanisms to secure profits while allowing room for additional upside.

Website: Pineify

Click here to view all the features of Pineify.Tips for Optimizing Take Profit Strategies

- Dynamic Take Profit Levels: Instead of using fixed percentages, consider adjusting your take profit levels based on market conditions. For example, you might increase the take profit percentage during strong uptrends.

- Multiple Take Profit Levels: Implement multiple take profit levels to scale out of positions gradually. This approach allows you to secure partial profits while letting the rest of the position ride.

Example:

- First Take Profit: 5% above entry

- Second Take Profit: 10% above entry

- Third Take Profit: 15% above entry

- Trailing Stop Loss: Combine take profit strategies with trailing stop losses to ensure that your stop loss moves closer to the current price as the trade becomes profitable, protecting more of your gains.

Common Challenges and Solutions

- Pine Script Limitations: While Pine Script allows for complex strategies, it has limitations, such as only allowing one full exit per strategy. To overcome this, use

strategy.close()for additional exit conditions. - Backtesting: Always backtest your strategies in TradingView to ensure they perform as expected before deploying them live.

Conclusion

Mastering Pine Script take profit strategies is essential for traders looking to automate their trading processes and maximize returns. By understanding how to set dynamic take profit levels, implement multiple exit points, and combine these with trailing stop losses, you can significantly enhance your trading performance. Whether you’re a seasoned trader or just starting out, optimizing your take profit strategies with Pine Script can help you navigate the markets more effectively.