Pine Script Strategy: Mastering Trailing Stops for Better Trading Results

Trailing stops are powerful risk management tools that can significantly enhance your trading strategy by locking in profits while allowing winning trades to run. In Pine Script, implementing trailing stops requires understanding both the concept and the technical implementation. This article will guide you through creating effective trailing stop strategies in Pine Script.

Understanding Trailing Stops in Trading

A trailing stop is a dynamic stop-loss order that automatically adjusts as the market price moves in your favor. Unlike a fixed stop loss, which remains at a set level, a trailing stop “trails” the market price by a specified distance. This mechanism serves several key purposes:

- Locks in profits as the trade moves favorably

- Reduces emotional decision-making in trading

- Automates risk management

- Provides an effective exit strategy for trending markets

When the market reverses by your specified distance, the trailing stop triggers an exit order, protecting your accumulated gains. This approach is particularly valuable in trend-following strategies, where the goal is to stay in a trade as long as the trend continues.

Implementing Trailing Stops in Pine Script

The TradingView Pine Script language offers robust capabilities for implementing trailing stops through the strategy.exit() function. Here’s how to effectively code trailing stops:

Basic Syntax

The strategy.exit() function handles trailing stops with these key parameters:

strategy.exit(id, from_entry, qty, qty_percent, profit, limit, loss, stop,

trail_price, trail_points, trail_offset, oca_name, comment, when)

The trailing stop-specific parameters include:

trail_price: The activation price for the trailing stoptrail_points: The distance in points to trail the pricetrail_offset: The initial offset from the current price

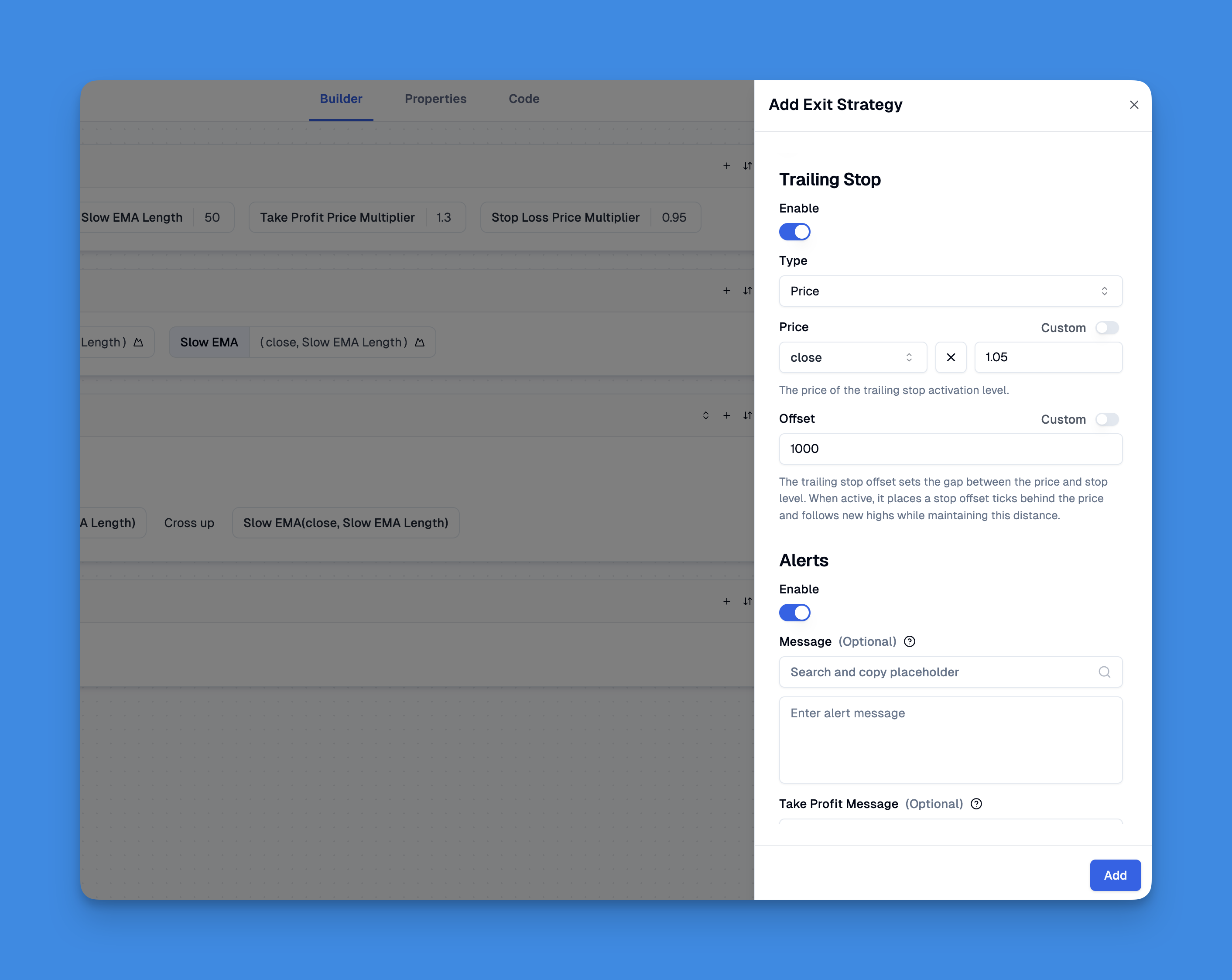

Revolutionizing Strategy Development with No-Code Solutions

In the ever-evolving world of trading, implementing effective trailing stops can be challenging, especially for traders without programming knowledge. Fortunately, tools like Pineify are transforming how traders develop and implement Pine Script strategies without writing a single line of code.

Pineify offers a comprehensive solution for traders looking to master trailing stops and other advanced trading techniques without the steep learning curve of Pine Script coding. Through its intuitive interface, you can create sophisticated trailing stop strategies by combining multiple technical indicators, price data, and custom conditions. The platform's powerful condition editor allows for precise rule construction that can be immediately visualized on your charts.

Website: Pineify

Click here to view all the features of Pineify.Step-by-Step Implementation

To create an effective trailing stop in Pine Script:

- Define your stop distance: Determine how far your stop should trail behind the price

- Track position status: Use variables to monitor if you’re in a long or short position

- Calculate and update the stop price: Adjust the trailing stop as the market moves favorably

- Implement the exit logic: Execute the exit when price hits the trailing stop

Here’s a simplified example for a long position:

float stopDist = 50 // $50 trailing distance

float stopLoss = na

if isLong

stopLoss := max(stopLoss, close - stopDist)

The max() function ensures the stop price only increases, which is essential for a proper trailing stop in a long position.

Types of Trailing Stops in Pine Script

You can implement different types of trailing stops based on your trading strategy:

Percentage-Based Trailing Stops

These stops trail the price by a fixed percentage, making them adaptable to different price levels:

float trailPercent = 10 // 10% trailing stop

float percentMulti = strategy.position_size > 0 ? (100 - trailPercent) / 100 : (100 + trailPercent) / 100

next_trailPrice := close * percentMulti

ATR-Based Trailing Stops

Using Average True Range (ATR) creates stops that adapt to market volatility:

atrValue = ta.atr(atrPeriod) * atrMultiplier

next_trailPrice := strategy.position_size > 0 ? close - atrValue : close + atrValue

Price Action-Based Trailing Stops

These stops use swing highs/lows to determine stop placement:

float swingLow = ta.lowest(low, swingLookback)

float swingHigh = ta.highest(high, swingLookback)

next_trailPrice := strategy.position_size > 0 ? swingLow - atrValue : swingHigh + atrValue

This approach allows your stops to respect market structure.

Best Practices for Trailing Stops

To maximize the effectiveness of your trailing stops:

- Balance tightness: A stop that’s too tight may get triggered by normal market fluctuations, while one that’s too loose could give back significant profits

- Consider market conditions: Trailing stops work best in trending markets and may be less effective in sideways or choppy conditions

- Test thoroughly: Backtest your trailing stop strategy across different market conditions to find optimal parameters

- Combine with other indicators: Use trailing stops alongside trend indicators to confirm market direction

Conclusion

Implementing trailing stops in Pine Script can significantly improve your trading strategy by automating profit protection while allowing winning trades to develop. By understanding the different types of trailing stops and following best practices, you can create sophisticated risk management systems that adapt to changing market conditions.