Crafting a Compelling Pine Script Scalping Strategy Article

Introduction to Pine Script Scalping

In the fast-paced world of cryptocurrency trading, scalping strategies have become increasingly popular due to their potential for quick profits. One of the most effective tools for creating these strategies is Pine Script, a programming language used for developing trading indicators and algorithms on the TradingView platform. This article will delve into the creation of a Pine Script scalping strategy, focusing on essential indicators and risk management techniques to help traders maximize their returns.

Understanding Scalping with Pine Script�

Scalping involves making numerous small trades throughout the day, taking advantage of small price movements. Pine Script allows traders to automate this process by incorporating various indicators into a single strategy. Key indicators for a scalping strategy include:

- Moving Averages (MA): Useful for identifying trends and potential entry points.

- Relative Strength Index (RSI): Helps in determining overbought or oversold conditions.

- Bollinger Bands: Indicate market volatility and potential breakouts.

Building a Scalping Strategy

To build an effective scalping strategy using Pine Script, follow these steps:

1. Setting Up Indicators

- Moving Averages: Use short-term MA (e.g., 20-period) to capture short-term trends and a longer MA (e.g., 200-period) for overall trend direction.

- RSI: Set the RSI period to 14 to identify overbought (above 70) and oversold (below 30) conditions.

- Bollinger Bands: Use a 20-period moving average with two standard deviations for the bands.

2. Defining Entry and Exit Rules

- Long Entry: When the short-term MA crosses above the long-term MA, and RSI is below 30.

- Short Entry: When the short-term MA crosses below the long-term MA, and RSI is above 70.

- Exit: Close positions when the RSI returns to neutral levels (between 30 and 70) or when the price touches the Bollinger Bands.

3. Implementing Risk Management

- Stop Loss: Set a stop loss below the recent low for long positions and above the recent high for short positions.

- Take Profit: Use a fixed percentage profit target or a trailing stop loss to lock in gains.

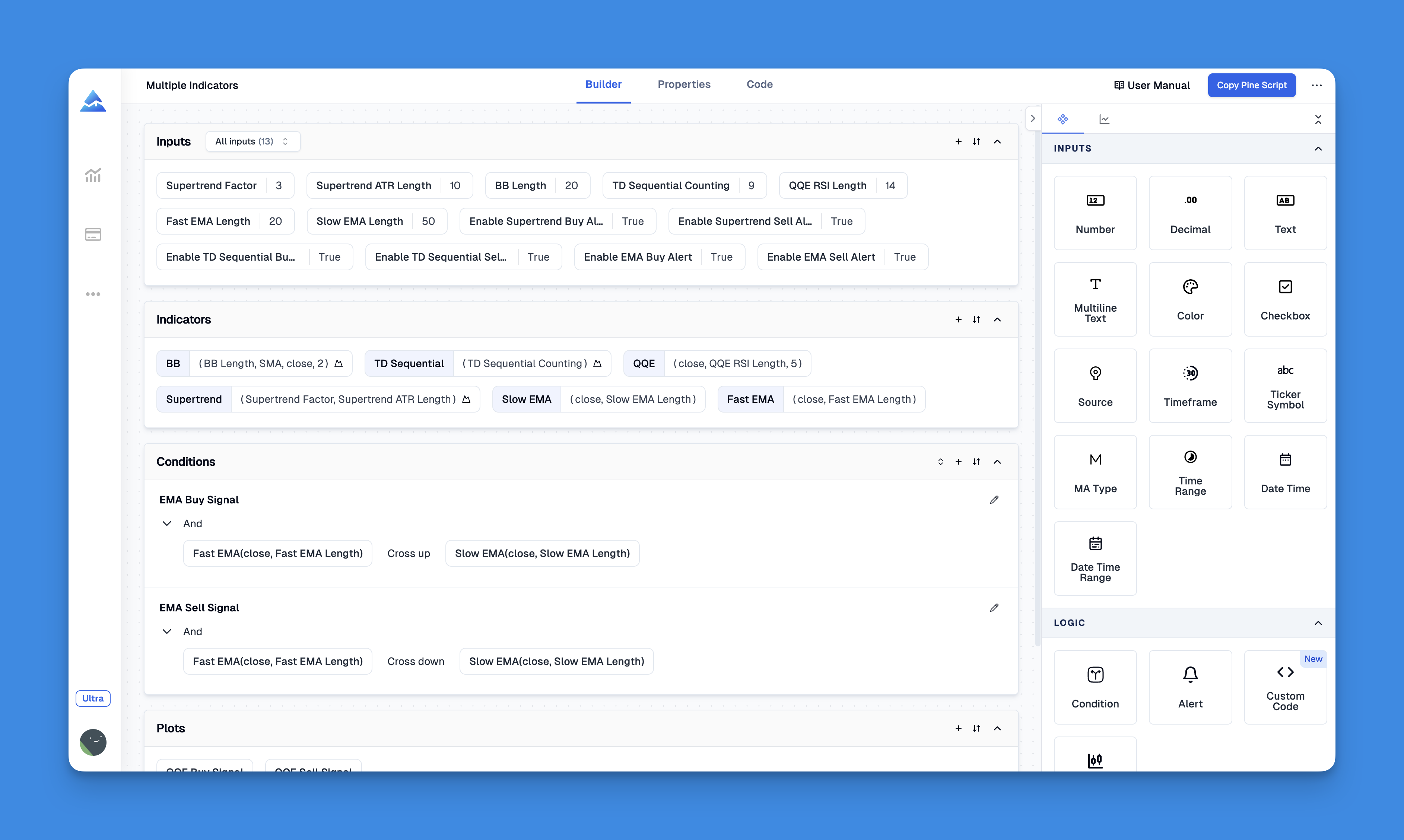

Building Your Scalping Strategy Without Coding: Leveraging Pineify's Visual Tools

When developing effective scalping strategies for TradingView, traders traditionally face two significant hurdles: programming knowledge requirements and indicator limitations. Pineify elegantly solves both problems with its intuitive visual interface designed specifically for creating sophisticated trading indicators and strategies without writing a single line of code.

For scalpers who rely on multiple technical signals for quick entry and exit decisions, Pineify's ability to bypass TradingView's two-indicator limit is particularly valuable, allowing you to layer unlimited technical indicators on a single chart regardless of your TradingView subscription level.

Website: Pineify

Click here to view all the features of Pineify.Example Pine Script Code

Here’s a simplified example of how you might implement these rules in Pine Script:

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Pineify

//======================================================================//

// ____ _ _ __ //

// | _ \(_)_ __ ___(_)/ _|_ _ //

// | |_) | | '_ \ / _ \ | |_| | | | //

// | __/| | | | | __/ | _| |_| | //

// |_| |_|_| |_|\___|_|_| \__, | //

// |___/ //

//======================================================================//

//@version=6

strategy("[Pineify - Best Pine Script Generator] Pine Script Scalping Strategy", overlay=true)

// Define indicators

lengthMA = input(20, title="Short MA Length")

longMALength = input(200, title="Long MA Length")

rsiLength = input(14, title="RSI Length")

bbLength = input(20, title="Bollinger Bands Length")

shortMA = ta.sma(close, lengthMA)

longMA = ta.sma(close, longMALength)

rsi = ta.rsi(close, rsiLength)

basis = ta.sma(close, bbLength)

dev = 2

upper = basis + dev * ta.stdev(close, bbLength)

lower = basis - dev * ta.stdev(close, bbLength)

// Plot indicators

plot(shortMA, color=color.blue, title="Short MA")

plot(longMA, color=color.red, title="Long MA")

plot(basis, color=color.blue)

p1 = plot(upper, color=color.green)

p2 = plot(lower, color=color.green)

fill(p1, p2, title="Background", color=color.rgb(33, 150, 243, 95))

// Define entry and exit conditions

if (shortMA > longMA and rsi < 30)

strategy.entry("Long", strategy.long)

if (shortMA < longMA and rsi > 70)

strategy.entry("Short", strategy.short)

if (rsi > 30 and strategy.position_size > 0)

strategy.close("Long")

if (rsi < 70 and strategy.position_size < 0)

strategy.close("Short")

Conclusion

Creating a successful Pine Script scalping strategy requires careful consideration of market indicators and risk management. By incorporating Moving Averages, RSI, and Bollinger Bands, traders can develop a robust system for identifying profitable trades. To further refine your strategy, consider experimenting with different time frames and indicator settings.