TD Sequential (TD9) Indicator Pine Script: The Ultimate Guide

The TD Sequential Indicator is a powerful tool for traders looking to identify potential trend reversals and exhaustion points in financial markets. Developed by Tom Demark, this indicator provides a structured approach to analyzing price movements through a unique counting mechanism. In this article, we will explore the TD Sequential Indicator, the innovative tool Pineify that simplifies its implementation, and how traders can effectively use these tools to enhance their trading strategies.

What is TD Sequential Indicator?

The TD Sequential Indicator is designed to identify points of trend exhaustion and potential reversals in price movements.

The TD Sequential Indicator is particularly effective in volatile markets, such as cryptocurrencies, where it can highlight overbought or oversold conditions that might not be apparent with traditional indicators like RSI or MACD. By providing clear signals for potential entry and exit points, it allows traders to make informed decisions based on market dynamics.

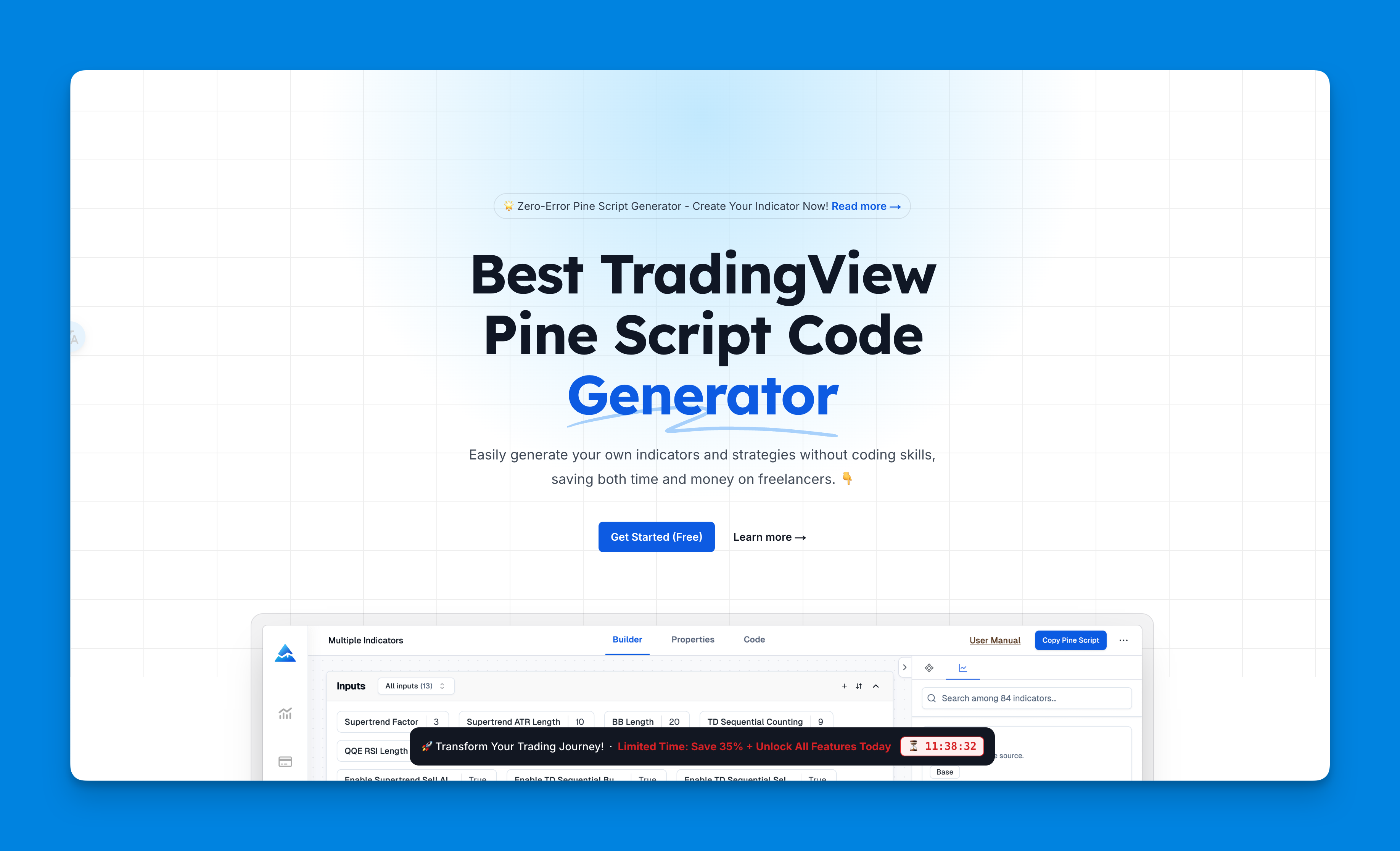

What is Pineify?

Pineify is a revolutionary tool designed for traders using TradingView, enabling them to create and manage trading indicators and strategies without requiring any programming skills. It offers several key features that make it an invaluable resource for both novice and experienced traders:

- Unlimited Indicators: Unlike TradingView's restriction of two indicators per chart, Pineify allows users to add as many indicators as they need, enhancing their analytical capabilities.

- Visual Tools: Pineify employs intuitive visual tools that enable traders to construct complex strategies quickly and easily, without needing to write code.

- Backtesting Capabilities: Users can backtest any generated indicator or strategy against historical data, ensuring robustness before deploying them in live trading scenarios.

- Custom Code Import: Traders can import their existing Pine Script code into Pineify, allowing for further customization and refinement of their strategies.

Pineify's user-friendly interface and comprehensive features make it an essential tool for anyone looking to optimize their trading strategies effectively.

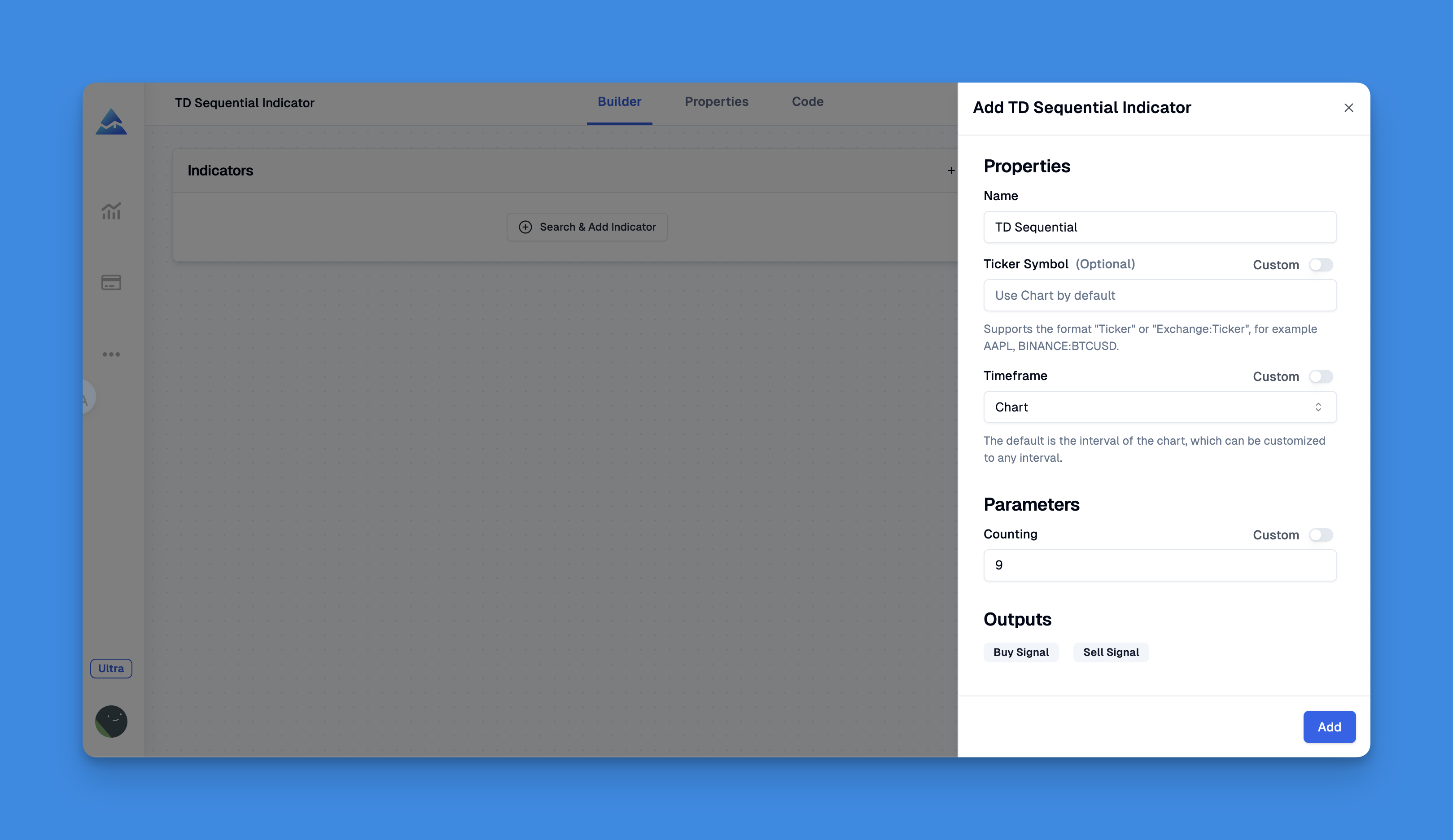

Add Tom Demark Sequential Indicator using Pineify

Integrating the TD Sequential Indicator into your TradingView setup using Pineify is straightforward:

- Access Pineify: Navigate to the Pineify platform and log in or create an account if you haven't already.

- Create a New Indicator: Use the intuitive interface to start building your custom indicator. Select "Add New Indicator" from the dashboard.

- Select TD Sequential: Choose the TD Sequential template from the available options. This template will provide a foundation for your custom indicator.

- Customize Settings: Adjust parameters such as candle count for Setup (9) according to your trading style.

- Visualize on Chart: Once configured, you can visualize your TD Sequential Indicator directly on your TradingView charts alongside other indicators.

By leveraging Pineify's capabilities, traders can seamlessly integrate the TD Sequential Indicator into their trading strategies without any coding hassle.

Click here to view all the features of Pineify.

TD Sequential Pine Script Code

For those who prefer working with code or want to customize further, here’s a basic structure of how the TD Sequential Indicator might look in Pine Script:

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Pineify

//======================================================================//

// ____ _ _ __ //

// | _ \(_)_ __ ___(_)/ _|_ _ //

// | |_) | | '_ \ / _ \ | |_| | | | //

// | __/| | | | | __/ | _| |_| | //

// |_| |_|_| |_|\___|_|_| \__, | //

// |___/ //

//======================================================================//

//@version=6

indicator(title="TD Sequential Indicator", overlay=true, max_labels_count=500)

//#region —————————————————————————————————————————————————— Custom Code

//#endregion ————————————————————————————————————————————————————————————

//#region —————————————————————————————————————————————————— Common Dependence

p_comm_time_range_to_unix_time(string time_range, int date_time = time, string timezone = syminfo.timezone) =>

int start_unix_time = na

int end_unix_time = na

int start_time_hour = na

int start_time_minute = na

int end_time_hour = na

int end_time_minute = na

if str.length(time_range) == 11

// Format: hh:mm-hh:mm

start_time_hour := math.floor(str.tonumber(str.substring(time_range, 0, 2)))

start_time_minute := math.floor(str.tonumber(str.substring(time_range, 3, 5)))

end_time_hour := math.floor(str.tonumber(str.substring(time_range, 6, 8)))

end_time_minute := math.floor(str.tonumber(str.substring(time_range, 9, 11)))

else if str.length(time_range) == 9

// Format: hhmm-hhmm

start_time_hour := math.floor(str.tonumber(str.substring(time_range, 0, 2)))

start_time_minute := math.floor(str.tonumber(str.substring(time_range, 2, 4)))

end_time_hour := math.floor(str.tonumber(str.substring(time_range, 5, 7)))

end_time_minute := math.floor(str.tonumber(str.substring(time_range, 7, 9)))

start_unix_time := timestamp(timezone, year(date_time, timezone), month(date_time, timezone), dayofmonth(date_time, timezone), start_time_hour, start_time_minute, 0)

end_unix_time := timestamp(timezone, year(date_time, timezone), month(date_time, timezone), dayofmonth(date_time, timezone), end_time_hour, end_time_minute, 0)

[start_unix_time, end_unix_time]

p_comm_time_range_to_start_unix_time(string time_range, int date_time = time, string timezone = syminfo.timezone) =>

int start_time_hour = na

int start_time_minute = na

if str.length(time_range) == 11

// Format: hh:mm-hh:mm

start_time_hour := math.floor(str.tonumber(str.substring(time_range, 0, 2)))

start_time_minute := math.floor(str.tonumber(str.substring(time_range, 3, 5)))

else if str.length(time_range) == 9

// Format: hhmm-hhmm

start_time_hour := math.floor(str.tonumber(str.substring(time_range, 0, 2)))

start_time_minute := math.floor(str.tonumber(str.substring(time_range, 2, 4)))

timestamp(timezone, year(date_time, timezone), month(date_time, timezone), dayofmonth(date_time, timezone), start_time_hour, start_time_minute, 0)

p_comm_time_range_to_end_unix_time(string time_range, int date_time = time, string timezone = syminfo.timezone) =>

int end_time_hour = na

int end_time_minute = na

if str.length(time_range) == 11

end_time_hour := math.floor(str.tonumber(str.substring(time_range, 6, 8)))

end_time_minute := math.floor(str.tonumber(str.substring(time_range, 9, 11)))

else if str.length(time_range) == 9

end_time_hour := math.floor(str.tonumber(str.substring(time_range, 5, 7)))

end_time_minute := math.floor(str.tonumber(str.substring(time_range, 7, 9)))

timestamp(timezone, year(date_time, timezone), month(date_time, timezone), dayofmonth(date_time, timezone), end_time_hour, end_time_minute, 0)

p_comm_timeframe_to_seconds(simple string tf) =>

float seconds = 0

tf_lower = str.lower(tf)

value = str.tonumber(str.substring(tf_lower, 0, str.length(tf_lower) - 1))

if str.endswith(tf_lower, 's')

seconds := value

else if str.endswith(tf_lower, 'd')

seconds := value * 86400

else if str.endswith(tf_lower, 'w')

seconds := value * 604800

else if str.endswith(tf_lower, 'm')

seconds := value * 2592000

else

seconds := str.tonumber(tf_lower) * 60

seconds

p_custom_sources() =>

[open, high, low, close, volume]

//#endregion ———————�——————————————————————————————————————————————————————————

//#region —————————————————————————————————————————————————— Ta Dependence

p_ta_sequential_candles(simple int counting) =>

buy_setup = 0

buy_setup := close < close[4] ? buy_setup[1] == counting ? 1 : buy_setup[1] + 1 : 0

sell_setup = 0

sell_setup := close > close[4] ? sell_setup[1] == counting ? 1 : sell_setup[1] + 1 : 0

buy_signal = buy_setup == counting

sell_signal = sell_setup == counting

[buy_signal, sell_signal]

//#endregion —————————��————————————————————————————————————————————————————

//#region —————————————————————————————————————————————————— Constants

// Input Groups

string P_GP_1 = ""

//#endregion —————————————————————————————————————————————————————————

//#region —————————————————————————————————————————————————— Inputs

//#endregion —————————————————————————————————————————————————�——————

//#region —————————————————————————————————————————————————— Price Data

//#endregion ———————————————————————————————————————————————————————————

//#region —————————————————————————————————————————————————— Indicators

[p_ind_1_buySignal, p_ind_1_sellSignal] = p_ta_sequential_candles(9) // TD Sequential

//#endregion ———————————————————————————————————————————————————————————

//#region —————————————————————————————————————————————————— Conditions

//#endregion ———————————————————————————————————————————————————————————

//#region —————————————————————————————————————————————————— Indicator Plots

// TD Sequential

if p_ind_1_buySignal

label.new(x=bar_index, y=0, yloc=yloc.belowbar, style=label.style_label_up, text=str.tostring(9), textcolor=color.rgb(255, 255, 255, 0), color=color.rgb(56, 142, 60, 20), size=size.tiny, text_font_family=font.family_monospace)

if p_ind_1_sellSignal

label.new(x=bar_index, y=0, yloc=yloc.abovebar, style=label.style_label_down, text=str.tostring(9), textcolor=color.rgb(255, 255, 255, 0), color=color.rgb(247, 82, 95, 20), size=size.tiny, text_font_family=font.family_monospace)

//#endregion ————————————————————————————————————————————————————————————————

//#region —————————————————————————————————————————————————— Custom Plots

//#endregion —————————————————————————————————————————————————————————————

//#region —————————————————————————————————————————————————— Alert

//#endregion ——————————————————————————————————————————————————————

This code snippet provides a basic implementation of the TD Sequential logic within TradingView’s Pine Script environment. Traders can modify this script according to their specific requirements or integrate it into Pineify for further enhancements.

How to Use TD Sequential Indicator

To effectively utilize the TD Sequential Indicator in your trading strategy:

- Identify Trend Exhaustion: Look for completed setups (9).

- Combine with Other Indicators: Use additional technical analysis tools alongside TD Sequential for confirmation of signals. This could include moving averages or volume indicators for enhanced decision-making.

- Set Entry and Exit Points: Establish clear entry points when a countdown completes after a setup signal. Conversely, consider exiting positions when opposing signals appear.

- Monitor Support and Resistance Levels: The indicator also helps identify critical support and resistance levels based on previous setups, aiding in risk management strategies.

- Backtest Strategies: Always backtest your strategies using historical data before applying them in live trading environments to ensure their effectiveness under various market conditions.

Conclusion

The TD Sequential Indicator is an essential tool for traders seeking to identify potential trend reversals and exhaustion points in financial markets. When combined with Pineify's user-friendly platform, it becomes even more accessible for traders without coding experience. By leveraging these tools effectively, traders can enhance their decision-making processes and improve their overall trading performance.

Ready to elevate your trading game? Try out Pineify today and experience how easy it is to create custom indicators and strategies without any coding hassle! Start building your trading success now!